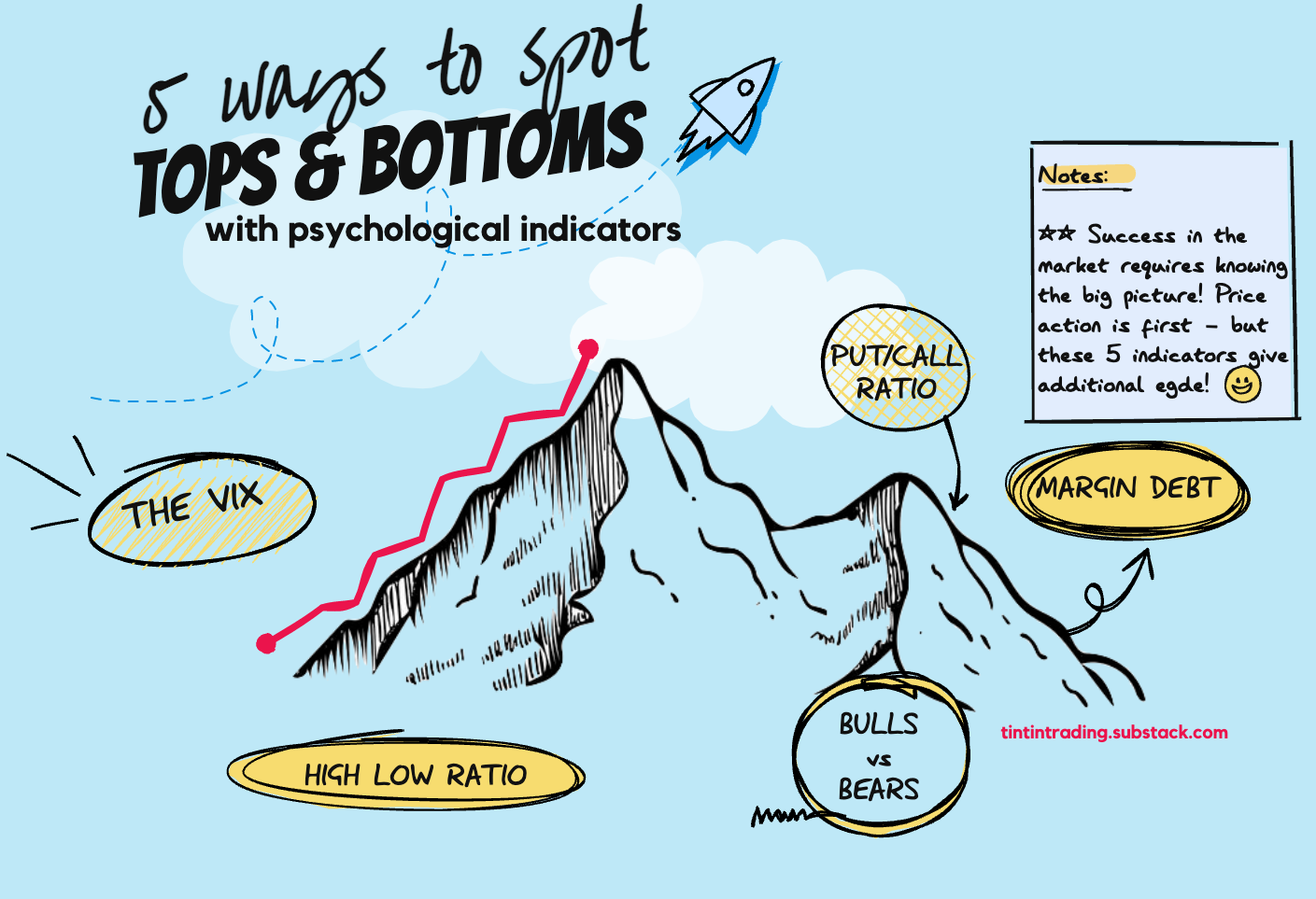

5 Ways to Spot Market Tops and Bottoms

How to recognise market turns? Check out these psychological indicators

About

Disclaimer: As per my methodology Price/Volume Action is most important. However! Many time price volume action can be boarder-line. Again following all rules that we have discussed, we are looking to stack things in our favour (I call this confluence of signals). The psychological indicators are secondary but give further edge to the trained eye.

Key Take Away

A VIX that is over 20% from it’s 10 day moving average signals a potential reversal

High-Low showing its first up day after crossing below 0.5 signals short term bottom in an intermediate correction during a bull market

Bull vs Bears when the Bears exceed the Bulls a market bottom is more likely

Put/Call ratio will surge above 1.0 when investors turn bearing. A reading above 1.15 can confirm a positive reversal in the S&P500 or Nasdaq

Margin Debt will exceed 55% when optimism runs rampant on the street.

The Indicators Explained

#1 VIX - estimates expected volatility based on the option prices of S&P500. When fear rules the volatility surges in the stock market. This is typically the time when the major indexes will hit bottom and rally higher.

#2 High Low Ratio - This looks at the ratio of new price highs vs new price lows. It can lag rebounds from correction during bull markets.

#3 Bulls vs Bears - This is a survey of various newsletter writers published by Investor Intelligence (there are a few similar surveys), that measures what % advice bearish and what % advice bullish.

#4 Put Call Ratio - Compares the total number of put options (bearish bets) vs the total number of call options (bullish bets). It helps determine the major short-term market bottoms.

#5 Margin Debt - This is the amount borrowed when buying on margin. Essentially a trader is paying part of the asset with their own money and borrow the other part from the broker. Keep an eye on year-over-year percentage change in total margin debt. It can flag a top in bull markets.

Where to find the psychological indicators?

Now you know about the different psychological indicators here is where you can source the information.

I personally use the products of Investors Business Daily (IBD) and in particular the IBD Digital subscription to find the psychological indicators. However, you could also find them in your trading platform. TradingView, Thinkorswim, Tradestation and stockcharts have most of these.