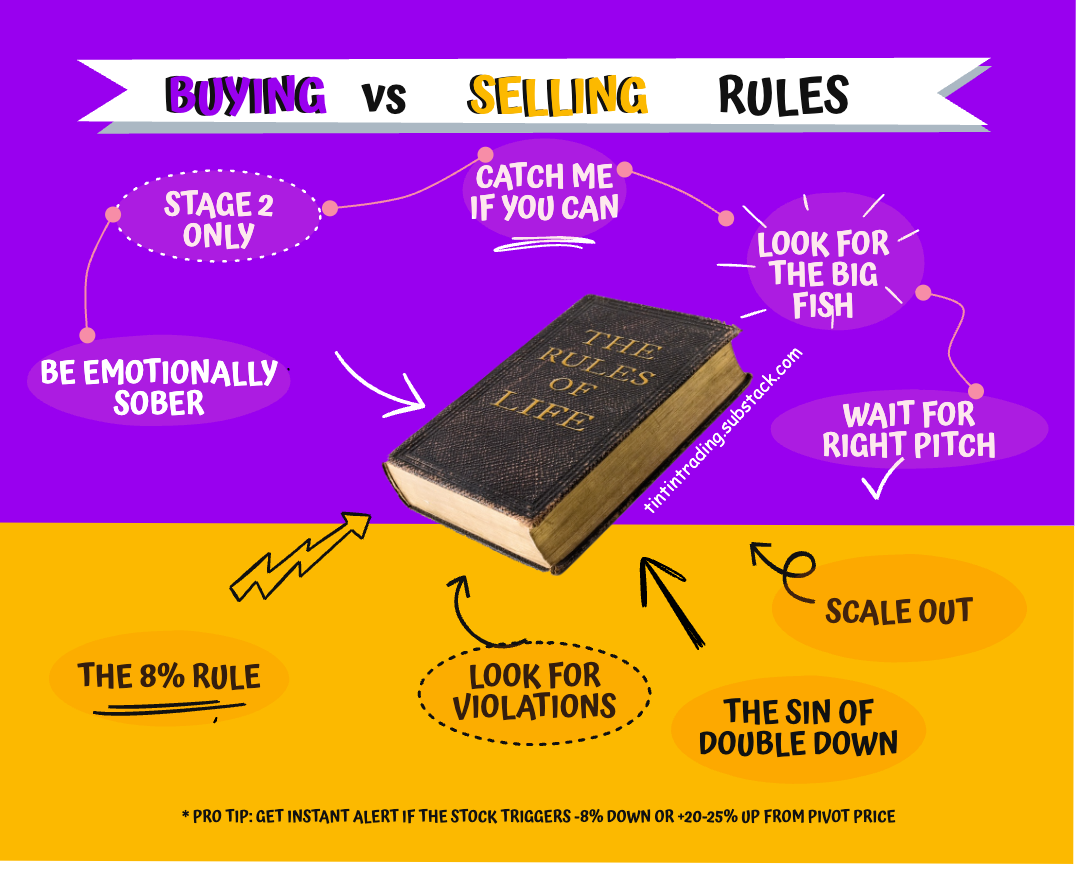

9 Rules for Buying and Selling Stocks

The Trading CAMP continues with another foundational article.

About

This weeks’ Trading Camp session is aimed at: RULES. Time tested rules and their disciplined following is a recipe for success in trading. As the old saying goes: Only perfect practice makes makes perfect. Practice creates a habit, so make good habits.

Key Points

Buying

Always be emotionally aware when making trading decisions

Never buy a stock in a downtrend

Do not chase stocks

Look for institutional accumulation

Buy on the way up

Selling

Scale out at 20-25% profit

Limit losses to 7-8% maximum

Do not double down

Watch for violating action that tips the probabilities against you

Buying rules

#1 The Emotional Check

The two drivers of trading decisions are fear and greed. They both sit on your left shoulder, like Lucifer, and whisper in your ear. Your task, comrade, is to silence these little buggers and stick to your rules! Remove the guesswork by studying charts and monitoring progress! If you find it hard, make a matrix of your rules and check how many criteria are met before entering a setup. If less than 70% of the rules are met, skip the trade.

#2 NEVER buy a stock on a downtrend

Especially for beginners, stacking probabilities in your favour is essential. This one rule will keep from a whole lot of trouble. This we call the Non-negotiable rule - always buy when a stock is in STAGE 2.

Credit to Minervini and Weinstein, who say that Stage 2 uptrend is checkbox number 1 before they buy. To learn about Stage Analysis come to our DISCORD room, where we have a course for Insider Members on Stage Analysis. Link to DISCORD - here.

#3 Do NOT chase extended stocks

Extended stocks tend to pullback. Chances are rather big to be honest (here is an article on studying the phenomenon here). Do not buy stocks more than +5% from the proper buy point (pivot breakout)! When the market is not strong I limit this to 1% away from the buy point.

#4 Watch for institutional accumulation

The institutions are the big fish that drive the market. Follow them and you will bathe in riches, cross their path and you will regret opening a trading account. Unlike me and you, my dear reader, institutions have an easy tale - volume. Since they A LOT, big volume is their footprints on the chart.

Pro tip: Look for Relative Strength Line (do not confuse with RSI indicator) compared to a market average (e.g. SP500 or Nasdaq Composite) and look for the stocks that have held up the best while the general market is making a down day.

#5 Scale up!

There is a given in the market: We know that sometimes we will be right and that sometimes we will be wrong. What can we do to hack things in our favour? a) Let winners run and cut losses down (more on this in the next section), but how about b) Scale up. Start with a pilot position if you are wrong - following a) will result in a tiny loss, if you are right, however, buy more - we call this pyramiding.

The rule is simple:

Pilot 1/3 of position size at pivot point breakout (e.g. 33 shares @ $100)

Another 1/3 of position size when the stock moves up +2% (+33 shares @ $102)

Another 1/3 of position size when stock moves up +5% (+33 shares @ $105)

This makes for 33*100+33*102+33*105 = 100 shares @ $101.31 (average price)

Selling rules

#6 8% Rule - Keep them losses small

This is the number one thing that everyone repeats and it is for a reason. The reason is that losses work geometrically against you! I also cover this concept in this video (link). The rule is simple: Do not let any trade go more than 8% against you (yes, my friend this includes open losses). If it does take it on the chin and admit it.

#7 Look for violations - aka institutional selling

These are technical setups that show that the stock is not favourable any more or that probabilities are no longer with you. Price falling on above average volume, making new high on low volume or repeatedly reversing off highs and closing near the lows. There are way too many to list all here, but I will give an example of something I post in our DISCORD server every day. That covers ‘good’ vs. ‘bad’ price action.

#8 Never double down

It is a skill to start thinking in probabilities (some books might help for sure) but if you understand the nature of normal distribution in trade outcomes, you would understand that averaging down, just does not make sense. Averaging down can have disastrous result - keep first buy a pilot (as per rule #5) and move on to the next setup.

#9 Take some profits at +20-25%

Sell most stocks when they are up +20-25%. Leading stocks tend to risks that much before slowing down, going sideways or pulling back. Take some chips off the table and improve your worst case scenario. Do not wait for fundamentals to deteriorate, since stocks sell the hardest when they look the best.

Still feeling knowledge hungry?

Here is a video I did on the subject of constructive buy action: