Riding the Power Trend to Increase Your Profits in the Trading Markets

A Guide for Intermediate Traders

Welcome to the Wild West of Trading, where the markets can be a harsh and unforgiving terrain, full of pit-falls and danger. But, with the right tools and strategies, you too can navigate this rugged landscape and rise out on top, just like the famous lawman Wyatt Earp. One of the most valuable tools in your trading arsenal is the Power Trend.

Table of Contents

1. The Power Trend: Your Trusty Companion in the Markets

2. The Three States of the Market

3. What are Power Trends?

4. When does a Power Trend end?

5. What is Power Trend Under Pressure?

6. How to use Power Trends?

7. The benefits of Power Trends

8. The power of discipline

9. Avoiding the pitfalls

10. How to increase success with Power Trends

11. Practical Examples of a Power Trends

"The Power Trend: Your Trusty Companion in the Markets"

Just like Wyatt Earp always rode with a clear and strategic plan, the Power Trend can help you maximize your profits in the stock market wether you are trading growth stocks or cryptocurrencies. A market in motion tends to stay in motion, and Power Trends help you get in and stay in when the market is in an unusually strong uptrend. The key to success in trading is to recognise these strong uptrends as early as possible and hop on the ride to make money while times are great.

😃😐😫"The Three States of the Market"

The market has three basic states: uptrends, downtrends, and rangebound motion. When the market is in a downtrend, it's easiest to stay out. But, rangebound markets can be frustrating, earning the nickname "the chop fest". The highest probabilities trades are the ones that happen when things are great. It's all about the uptrends, and not all are created equal. Some are longer and stronger than others, so it's important to recognise them as early as possible and the Power Trend is here to help.

🤷♂️What are Power Trends?

A Power Trend is a strategy that helps you get in and stay in on unusually strong uptrends in the market. By recognizing these trends early, you can maximize your profits. We have identified the strongest uptrends in Nasdaq's trading history and created black and white rules to identify them. A Power Trend starts when four things happen simultaneously:

The low is above the 21-day exponential moving average (EMA) for at least 10 days.

The 21-day EMA is above the 50-day simple moving average for at least five days.

The 50-day line is in an uptrend (one day is sufficient).

The market closes up for the day.

✋When does a Power Trend end?

A Power Trend typically ends when the 21-day EMA crosses back below the 50-day. However, two rare cases can turn it off early: a circuit breaker and a follow-through day failure. A follow-through day failure is when the rally undercuts the follow-throughs day low. A circuit breaker is when the futures fall 5%, they trigger the "limit down" circuit breaker and trading is halted, so they can't go any lower.

😰What is Power Trend Under Pressure?

There is another state of the Power Trends for the experienced in the Wild West. We call it Power Trend Under Pressure. The conditions that turn the Power Trend Under Pressure are a minor low signal or when distribution clusters has occurred. Additionally, it might trigger when the price breaks below the 50-day MA. When you get Power Trends Under Pressure then traders are advices to stay off margin but still allowed to keep over 75% market exposure. In order to reset a Power Trend from Under Pressure to normal Power trend we want to see the following conditions:

10 consecutive days must pass without a minor low signal

10 consecutive days without distribution clusters

⚒️How to use Power Trends?

Just like Wyatt Earp, you should be aggressive when the odds are in your favour. Power Trends are the times to play aggressive offense with 100% discipline. According to Investor's Business Daily, traders are permitted to exposure more than 100% and deploy margin to trade. Consider investing in more aggressive growth names that break out of sound bases and pyramiding into positions showing progress.

✅The benefits of Power Trends

Using Power Trends can lead to many benefits in the stock market, including:

Increased profits when the environment is good

Better understanding of market conditions

Improved reliability and accuracy in your trading decisions

💪The power of discipline

In the Wild West, discipline was key to survival. The same goes for the stock market. With the Power Trend as your guide, make sure to stay disciplined in your trading to maximize your profits and support your goal of outperforming the indexes times over.

⚠️Avoiding the pitfalls

Just like in the Wild West, the stock market has its dangers. It is crucial to limit losses as they progressively work against your PL curve. A common mistakes among newbie traders is to try and recoup lost money when the health of the market is not optimal. Worse off is to try and use leverage in your orders which can carry massive risks. Be aware of downtrends and rangebound markets and avoid them to increase your chances of success.

The stock market can be a harsh and unforgiving place, but with the right tools, you can navigate it and come out on top. The Power Trend is a reliable and effective tool that can help you strike it rich in the Wild West of trading.

🏆How to increase success with Power Trends

To increase your success in trading and get Power Trends and 25 more similar rules, be sure to grab a copy of my version IBD's Market School Indicator for TradingView. It will give you a reliable edge in the Wild West of Trading. You can learn more about it here and grab the indicator here:

📚Practical Examples of a Power Trends

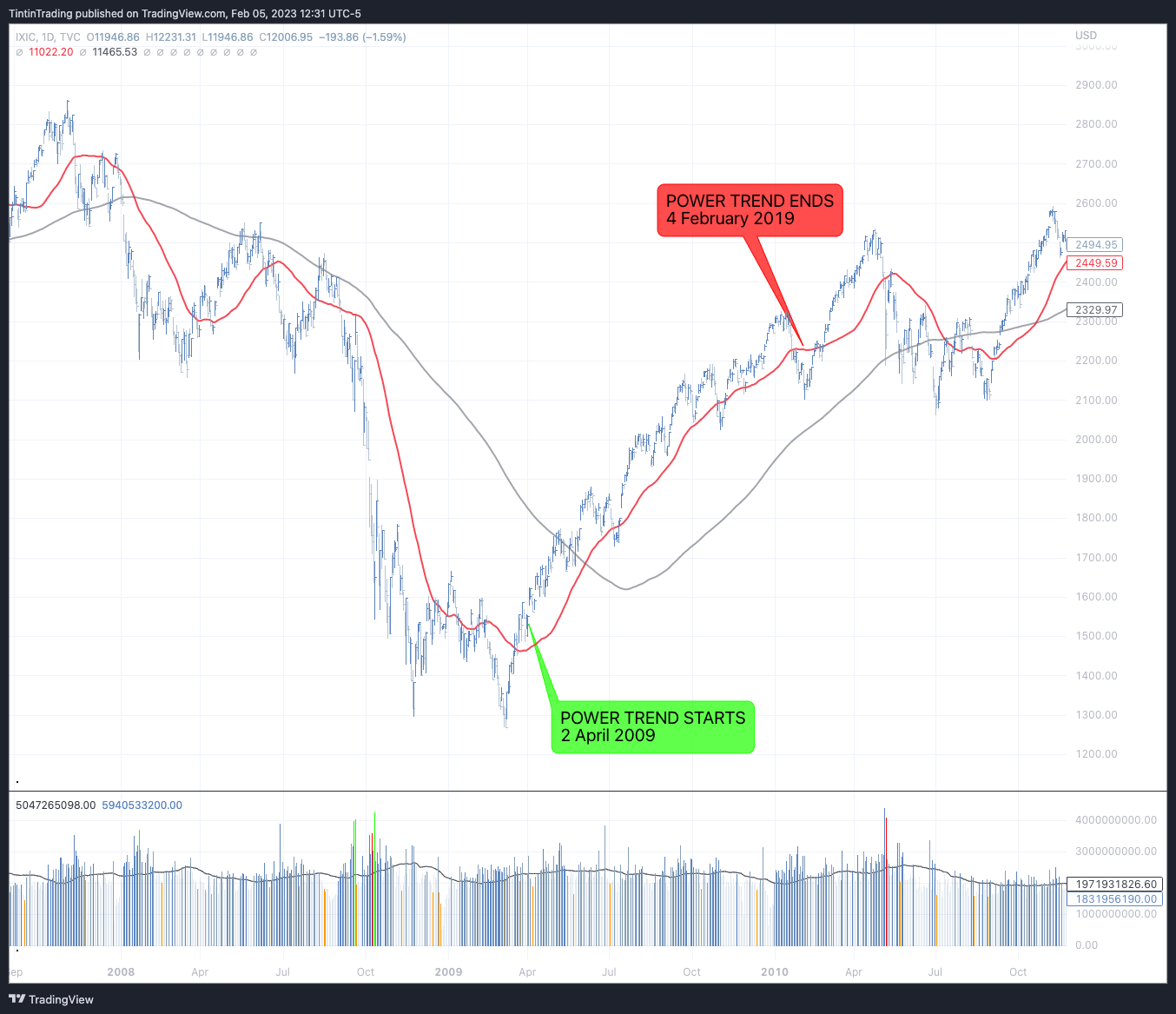

In the first example we have a recent study of 2010 that shows that the power trend started on April 2, 2009 and continued until February 4, 2010. The market had a powerful move and advanced 52% in 200 days and had less than 6% decline along the way.

A second example is the 1980s. I use this period as I wanted to emphasize that these signals are really timeless. The initial Power Trend was turned on 22 May 1980. From then on the market surged 32% in less than 100 days without correcting more than 5%. The example also shows 2 Under pressures on 16 October 1980 and 08 December 1980 and one ending on 18 December 1980.

So grab your cowboy hat and saddle up, it's time to ride the Power Trend to success in the stock market. With discipline, strategy, and the right tools, you can make a profit without relying on guest work no more. Yeehaw!