🧩Table of Contents

1. Introduction

2. Allure of IPOs

3. How to learn more about IPO Trading

4. Lifecycle Phases of IPO

4.1 IPO Advance Phase

4.2 Institutional Due Dilligence

4.3 Institutional Advance Phase

4.4 Mature Phase

5. Sell Strategies for IPOs

6. Practical Examples

7. More Rules

8. Conclusion👋Introduction

When it comes to investing, diving into the realm of Initial Public Offerings (IPOs) can be an exhilarating, and possibly highly profitable, adventure. It requires a keen understanding of the IPO journey, from the essential skills needed to decode the intricacies of the process to interpreting risk management metrics that can optimize your returns. This article will shed light on the multifaceted world of IPOs, emphasizing investment banks' roles, regulatory bodies involved, and the array of public structure factors triggering IPO decisions. Additionally, it will guide you through practical examples, price benchmarks, percentage breakdowns, and analytical methods to aid in successful IPO navigation.

✨The Allure of Initial Public Offerings

THE IPO HYPE: The glamour of IPOs is often rooted in the chance to invest in some of the world's most groundbreaking companies as they debut in the public domain. These emerging companies, with their rapid growth and momentum, stand to revolutionize the world. An investment bank, which plays a crucial role in this process, along with the company's chief financial officer and a team involved in the initial public offering, collaborates to make this transition possible. The allure of IPOs is their potential for significant price jumps in a brief window of time, such as seeing a company's stock rise from $25 to $45. However, it's important to remember that a successful IPO is not guaranteed, emphasising the necessity of a thorough due diligence process to understand the risks involved.

PROABILITIES FROM IPO BASES: A significant aspect of IPOs that contributes to their allure is the formation of what is known as "IPO bases." According to definitions provided by Investor's Business Daily and the renowned investor, William O'Neil, these bases are essentially specific patterns or consolidation periods that form in the stock's price following its IPO. Research and historical analysis show that these bases can serve as launching pads for what are often referred to as "Super Growth Stocks."

Statistical analysis further bolsters the importance of these IPO bases. Remarkably, around 15% of Super Growth Stocks are found to originate from IPO bases, the highest percentage among all base types. This considerably surpasses the probability of other base patterns leading to Super Growth Stocks:

flat bases (5%)

double bottom bases (7%)

consolidation bases (8%)

ascending bases (10%)

saucers with handles (6%)

saucers without handles (4%)

cups without handles (8%)

cups with handles (8%).

This statistical revelation emphasizes the influential role of IPO bases in cultivating stocks that exhibit extraordinary growth. However, it's important to remember that while the creation of an IPO base can potentially set the stage for significant returns, it doesn't guarantee success. The company's fundamentals, market conditions, and other public structure factors triggering the company investment banks to decide on the most favorable timing for the IPO also play crucial roles in the stock's eventual performance. Trading successful initial public offering is a skill on its own, since many of the technical analysis criteria taught by Market Wizards do not apply here, since, well...there is near no trading history 🤷♂️.

HOW MUCH WOULD YOU HAVE MADE: To further illustrate the seductive power of IPOs, let's consider the potential of massive returns that they offer, often unmatched by other investment opportunities. Imagine investing $10,000 in the IPOs of Amazon (AMZN), Apple (AAPL), Netflix (NFLX), and Tesla (TSLA), some of the most successful companies of our time. The returns on these investments would have been extraordinary, providing a testament to the incredible upside potential inherent in initial public offerings. Lets look at the wall of fame 🤑.

Amazon, the e-commerce behemoth, launched its IPO in 1997. An investment of $10,000 at the time of the offering would have transformed into a staggering $23 million at its peak, reflecting the company's exponential growth trajectory.

Apple, the tech giant that revolutionized personal computing and mobile technology, had its IPO in 1980. A $10,000 investment in Apple's IPO would have yielded a return of about $17.9 million at its peak.

Netflix, the streaming service that transformed the way we consume media, had its IPO in 2002. An initial investment of $10,000 would have ballooned to an impressive $6.4 million at its peak value.

Tesla, the electric car manufacturer that is redefining automotive industry standards, went public in 2010. A $10,000 investment at its IPO would be worth $3.4 million at its peak.

These examples underscore the tremendous upside potential of IPOs. However, they also serve as a reminder that not all IPOs are created equal. It takes the perfect confluence of innovation, execution, market acceptance, and skill to identify and ride successful initial public offering in order to replicate the successes of Amazon, Apple, Netflix, and Tesla. And this is where we come in.

How to learn more about IPO Trading?

IPO COURSE: For those who are serious about mastering the art of trading IPOs, our IPO course can be an invaluable resource to accelerate your learning curve. Our comprehensive IPO training course can provide you with the essential skills and knowledge needed to navigate the IPO landscape successfully. From understanding the IPO process to learning about the various parties involved, the IPO course can equip you with the tools and insights needed to make informed investment decisions and drastically increase the probabilities to your side.

COURSE COMPARISON: We have done a high level comparison on the content of the top 3 IPO courses on trading and we are confident that the TinTinTrading Course provides amazing value for money.

THE LITTLE TEXT: Where is our secret? We manage to provide the highest quality educational materials because we leverage on decade long trading experience and insights from hundreds of lectures and seminars, including the Lifecycle Trading Team (Kathy Donnelly, Eve Boboch, Eric Kroll, Kurt Daill) and Investor's Business Daily Team (William O'Neil, Mike Webster).

🔄The Lifecycle of an IPO (the IPO Phases)

Here is a sneak peak of some of the ideas that we dive deep into the IPO Trading Course. The journey to a successful IPO usually involves a sequence of distinct stages. The Stage invention credit is due to the Lifecycle Team, who separated the IPO process into 4 major trends.

FOURS IPO PHASES: Our IPO course often emphasises these phases as they provide valuable insights into potential stock performance, thus aiding investors in making informed decisions. I like to think of them as the high level map of the IPO journey. Here is a brief description of them to give you a basic understanding of the world of initial public offering trading.

🍾IPO Advance Phase (AP)

This phase occurs immediately after the IPO and can last for a few days to a few months. During this period, the stock price often experiences a significant increase due to initial excitement and hype. However, this phase can also be characterized by high volatility, as the market is still trying to accurately price the stock The price sensitive information disclosure during this phase, managed by the team involved in the initial public offering, is crucial. As an investor, it's crucial to be cautious during this phase and not get carried away by the initial hype. On the chart above this is the cyan phase.

🧐Institutional Due Diligence Phase (DD)

Following the initial advance, the stock price typically declines or consolidates as institutional investors conduct their due diligence. This phase can last from a few months to a few years. During this period, private equity firms and advisers like treasury managers and auditors assess the company's fundamentals, including its financial health, business model, and growth prospects. As a retail investor, this phase can provide an opportunity to observe the stock's performance and gather valuable information about the company as well as essential information about the company's governance and accounting methods valuation. Generally, retail traders would want to skip this phase and not hold position into the stock. This is because of the concept of opportunity cost. Instead of deploying the money on a non-goer (which has no guarantee it will go up again), it is best to play the AP phase and skip the DD phase.

🚀Institutional Advance Phase (IA)

After the due diligence phase, institutional investors start to research accumulate the stock, leading to a new price advance that we call Institutional Advance Phase. This phase can result in substantial gains for investors who held through the due diligence phase or bought in during this period. The institutional advance phase is often a sign of growing confidence in the company's prospects, making it a potentially favorable time to invest. This is another skyrocketing moment for the stock and traders would want to identify this as early as possible in order to benefit greatly from the whole move. We can say that stocks that are undergoing a institutional advance phase are really successful initial public offering.

👵🏽Mature Phase (MP)

Finally, the stock transitions into the mature phase, where it behaves more like a traditional stock with less volatility and more predictable price patterns. By this stage, the company's fundamentals and growth prospects are usually well-understood by the market, and the stock's price is more likely to reflect its intrinsic value. The Mature Phase is excluded from our IPO complete course since at this point standard technical analysis applies.

♟️Sell Strategies for Trading IPOs

Trading IPOs requires a unique set of strategies to navigate their inherent volatility and capitalize on their potential for high returns. These of course are dependent on risk appetite but all are time tested by the Lifecycle Team and their research has time tested them across large set of IPOs to prove statistical significance. There are Fast, Steady and Slow rules.

🚨INDICATOR AUTOMATION: Some of these selling rules are very complex and we have taken the liberty to create an automatic trading indicator for Trading View that can help you apply the Lifecycle Sell Rules. Course students get a special discount but essentially the course is a complete match with the book:

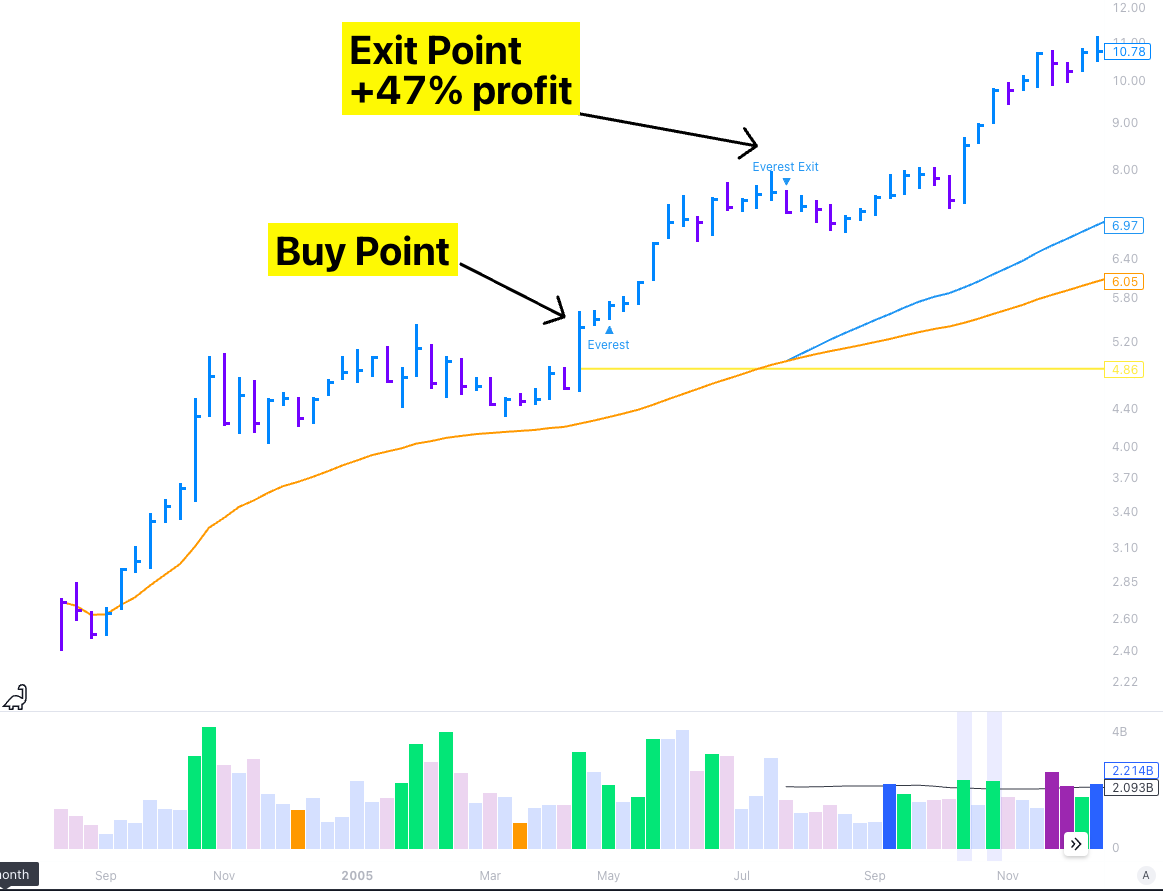

🏔️The Everest Rule

The Everest Rule is a risk management strategy specifically designed for the volatile IPO Advance Phase. The rule uses 9 separate conditions to determine exact sell moment. This rule helps to lock in profits and prevent substantial losses during the often unpredictable IPO Advance Phase. It's a practical strategy that can help you navigate the volatility of new issues while protecting your investment. It is great as it protects from Large Losses but this is also its weak point, since it can shake you out before the top. Here is a simplified version of the rule, the more complex version of the rule is coded in this indicator:

Sell when the stock of your shares when the stock exhibits a steep, accelerating climb and subsequently closes beneath the intraday low from two days prior.

If the stock had a significant price jump at the opening compared to the previous day, consider a closing price lower than the minimum price of this jump day as an indication to sell.

The rule restarts its cycle when the stock reaches new peak prices.

Below we have done a theoretical example with $GOOGL and an entry point on 18APR05.

🧗🏻♀️The Ascender rule

The Ascender Rule aims to capitalize on the rapid, robust upward movement of a stock that has recently undergone an Initial Public Offering (IPO) and is demonstrating strong positive momentum. Essentially, the rule is applied to maximize profits during the IPO Accumulation Phase (AP). By employing this rule, a part of the position is retained in anticipation of the stock continuing its upward surge directly to the Institutional Advance Phase (IA). This selling rule is fundamentally aggressive but with a protective element. The conditions of the rule are:

Sell of half of the holdings when the daily closing price is 3 percent lower than the 21-Day Exponential Moving Average (EMA).

Sell a quarter of the position when the daily closing price drops 3 percent below the 50-Day Simple Moving Average (SMA).

Liquidate the remaining quarter either when the stock price falls below the buying price, after 18 months from the purchase point, or after it has increased by 500 percent, depending on whichever scenario unfolds first.

The Ascender Rule has proven to be effective during both the IPO-AP and IA, and is especially effective for stocks demonstrating remarkable strength, such as the Rocket Ship and Stair Stepper pattern (pattern names are covered in our complete course on Initial Public Offerings).

The main advantages of the Ascender Rule are securing some profits early on from a significantly profitable position and the potential for considerably larger profits from the portion of the position held longer. Lower declines in value also make this rule preferable compared to other tested selling rules. However, potential downsides of the Ascender Rule include the risk of selling too early or relinquishing profits from a part of the position.

On average, when the Lifecycle team tested the Ascender Rule it led to a gain of 51 percent and a decline of $57,000. The rule was particularly successful during eBay's rise, which began in October 1998, shortly after its IPO.

🥈Midterm Rule

The Midterm Rule is structured to prevent premature sale of a successful stock and strives to sustain an IA. This rule is usually implemented after the DD at the onset of the IA, ideally beyond the turbulence zone (this is also covered in our IPO course). This rule is seen as a protective sell rule. The rule is triggered by the following conditions:

Sell if there are two successive closes below the 10-Week SMA, with a further 6 percent drop (intraday) from the lowest price of those two weeks (intermediate-term trigger); or

Sell when there's the first weekly close below the 10-Week SMA after a 1-Year hold (long-term trigger); or

Sell if the stock's closing price for the week is 30 percent lower than its highest value; or

Sell if the weekly close falls below the 40-Week SMA.

Research indicates that the Midterm Rule is more effective during the IA compared to the IPO-AP because the IA is generally less volatile. The rule has shown impressive results, especially for Pump and Dump and Stair Stepper patterns in our sample testing (more on patterns in the course where you will get a 51 page Model Book to have multiple examples of all patterns).

The Midterm Rule's primary advantage is the opportunity for significantly higher profits from a successful stock since the position is usually maintained through normal corrections. The main disadvantage is the substantial decline when a sell signal is triggered by the rule compared to most other rules.

The Midterm Rule demonstrated a median profit of 70 percent along with a median drawdown of $66,000. The rule proved extremely successful on the advance of Facebook's stock, which began with a breakaway gap in July 2013 following the completion of the DD.

📆40 Week Rule

The 40-Week Rule is intended to hold onto a successful stock for an extended period (a year or more) during the IA phase to secure substantial profits. It's considered a protective selling strategy. The guideline is as follows:

• Dispose of the stock on the first weekly (Friday) closing price that is more than 1 percent below the 40-Week SMA.

The rule tends to be effective when attempting to maintain a lucrative position after the DD and during the IA, based on study results. This rule seems to be exceptionally beneficial for Stair Stepper, Late Bloomer, and Pump and Dump patterns in our testing sample.

The major advantage of the 40-Week Rule is the potential for transformative profits when used with the right stock, like Amazon, which trends above the 40-Week SMA. The main disadvantage is the significant drawdown it entails in comparison to other rules we've analyzed.

The 40-Week Rule achieved a median gain of 81 percent and a median $102,000 drawdown in the Lifecycle studies. It demonstrated remarkable performance on Amazon's impressive ascent from its initial base in 1997.

🚨REMEMBER: All of these rules are available from an automatic indicator that plots the buys and sells on the chart for you. Learn more here.

💎Look for the Rare Jewels

Only about 10% of IPOs turn into "rare jewels" – stocks that increase by 500% or more from their IPO price. Identifying these potential rare jewels early can lead to life-changing returns. To spot these opportunities, look for stocks that increase by 100% or more within their first 90 days of trading and have a daily dollar volume of $20 million or more. However, it's important to note that while these stocks offer high potential returns. Knowing how to pick an IPO is the essential skills and can produce life changing returns.

📺Practical Examples

To better understand these concepts, let's consider a couple of use-cases:

☎️Twilio ($TWLO)

Twilio, a cloud communications platform, is an example of a "rare jewel." After its IPO in 2016, the stock increased by over 500% in its first few years of trading. Investors who spotted this potential rare jewel early could have achieved substantial returns. However the move, as seen on the picture below is not straight up. First part of the move was created during the IPO advance phase where the stock soared +125% in just 8 weeks. Afterwards, as mentioned before $TWLO entered a longer sideways Due Diligence Process (or DD Phase), where if you were holding you would have lost a) money and b) time. At the breakout of the DD phase the stock showed the characteristics we looks for for IA phase, this was the beginning of a +245% Institutional advance phase

📸GoPro ($GPRO)

GoPro's IPO is a classic example of the volatility and potential rewards associated with investing in newly public companies. GoPro's stock price experienced a significant surge following its IPO Advance Phase (AP), with the stock price increasing by 88% in just 22 days. However, after the initial surge, GoPro's stock price began to decline, eventually reaching a low of around $5 to $10 per share. This rapid decline underscores the importance of managing risk when investing in IPOs. Many of these stocks sky rocket and then decline fast, so strict rules like the ones described in the previous section are required to maximize your returns and protect you from holding a loser.

👩🏫More Rules and Guidelines

As mentioned a few times during this articles Initial Public Offerings can provide great gains but also are subject to volatilities and fast declines. The little historical data, makes them unique and anomaly to many of the breakout rules that established schools of thought like Investor's Business Daily are teaching. This is why we created our IPO course, to explain the IPO process and showcase the rules how to ride a successful initial public offering.

⚠️Risk Management

Always consider the potential risk before investing in an IPO. The potential rewards can be high, but so can the risks. Always plan ahead and know how much risk you're willing to take. Generally the rule is to take 1/2 of a normal position for an IPO. This is because the inherent increase risk. Therefore, if my normal full position size in an equity is 25% (during strong bullish markets), for an IPO trade it would be between 10-12%.

⏰Timing

Timing is crucial when investing in IPOs. If you're not there at the right time, you might miss out on significant gains. These guys move fast and you have to be very diligent on your timing. The large volatility during the initial AP phase, makes it another reason why you want to time entries, rather than hop and wait.

✈️Avoid Buying at Highs

Avoid buying an IPO stock when it's significantly extended from its base. If a stock is up 39% in a day, for example, it might be better to wait for a breakout from the turbulent zone or out of the IPO Base (we cover both of these concepts in our IPO training course).

✂️Cut Losses Quickly

I am a critic of holding loses (you might have read around my articles why). This is especially trie for an IPO stock. These are very risky plays, it's important to cut losses quickly, especially when probabilities point to a large decline. Many IPOs can fizzle out quickly, and it's crucial to protect your investment.

🏁Conclusion

Trading IPOs can be a rewarding strategy, but it requires a deep understanding of the IPO lifecycle and the application of appropriate risk management strategies. By recognizing the different phases of an IPO and using tools like our indicator to spot the Everest Rule and the 10-week line, traders can navigate the volatility of new issues and potentially capture significant gains.

Remember, not all IPOs will turn into Rare Jewels, and some may even become "one-hit wonders" that experience a significant price increase before declining. Therefore, it's crucial to conduct thorough due diligence and maintain a disciplined trading approach. There are many nuances around the IPO trading, which is why we created our complete course on IPOs.

Finally, keep an eye on market conditions. During turbulent times, even strong IPOs can experience significant price declines. Therefore, it's essential to have a plan for managing risk during such periods.

In the world of IPOs, knowledge is power. The more you understand about the lifecycle of an IPO and the strategies for trading them, the better equipped you'll be to capitalize on these unique investment opportunities. By staying informed and applying these strategies, you can navigate the dynamic world of IPOs and potentially achieve significant returns.

Thank you!

💡These posts consume most of my Sundays! If you have received value:

Share it on Twitter (using the button below)

Subscribe to the newsletter.

This way You will help grow the community together!