Maximizing Profits with Progressive Exposure: The Mark Minervini Trading Strategy

Position sizing strategy to maximize your returns

PROGRESSIVE EXPOSURE has been the single biggest lesson that had a profound impact on my results after being an apprentice of the stock market wizard Mark Minervini for many years and learning his methodology by heart.

Table of Contents

1. Why It Matters

1.1 What is Progressive Exposure

2. Required Components of Progressive Exposure

2.1 Probabilistic Thinking

2.2 Asymmetric trading

2.3 Limiting Loses is a key

3. Practical Take-aways for Progressive Exposure

3.1 Mark's 5 thinking principles

3.2 Example of Progressive Exposure

4. Advantages and Limitations

4.1 Advantages

4.2 Limitations

5. My Progressive Exposure Rules

5.1 Rule 1

5.2 Rule 2

5.3 Rule 3

6. ConclusionWHY IT MATTERS?

By employing Progressive Exposure, traders ensure that they are trading their largest when the market is the easiest and trading the smallest when the market is the hardest. It is applicable to any trading style, timeframe or trading instrument.

🤷♂️ WHAT IS PROGRESSIVE EXPOSURE TRADING

It is a position management strategy involves gradually increasing your market exposure as you gain more wins with trading. By taking advantage of this method, you can increase your chances of making profitable trades when the market is easy while reducing the risk associated with investing in stocks while the market is difficult.

Required Components of Progressive Exposure

🧠 PROBABILISTIC THINKING

Successful trading is an endeavour that relies on probabilistic thinking. One the difference between an experienced and a junior trader is that the experienced trader knows that wins and losses are normally distributed, but only in the long term. In the short term a 50/50% winning system can produce multiple losses in a row. This is because the loss or profit outcome is majorly distributed on the larger market environment. Mark Minervini calls the period where the market produces many winners an "easy dollar environment" versus the market that produces many losers a "hard penny environment" Hence, a hard penny environment is a period in the market when the probabilities of a trade a lower.

🤑 ASYMMETRIC TRADING

In essence, progressive exposure relies on the idea that by slowly entering into the markets with small amounts of money at first, traders can reduce their risk while they learn what works and what doesn’t in terms of trading strategies. As they accumulate knowledge and confidence, they can gradually increase their positions size to capitalize on larger gains as their comfort levels grows that they are in easy dollar environment. This approach also allows traders to gain insights about the market environment before committing large amounts of capital to the market.

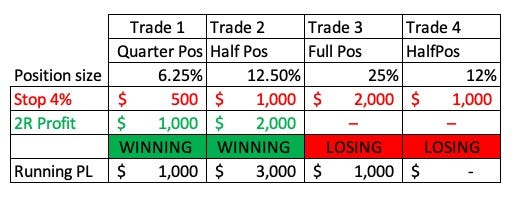

As a breakout trader, Mark Minervini preaches a 2:1 Reward:Risk trading style. A 2:1 trader is an additional tool that reinforced the principles of proper risk management. In essence, every win is twice as big as every loss, and when you increase size, the trader finances every bigger trade with the smaller winner. Here is an example:

✋ LIMITING LOSSES IS A KEY

The main advantage of progressive exposure is that it prevents traders to incurring large losses if their trades go wrong for a substantial period of time. Preventing large losses preserves capital and has a compounding effect on the traders' Profit and Loss. You can read more about this in my article about Compounding. The process provides a form of “risk insurance” as traders can evaluate various techniques before deciding to increase exposure in order to maximize their profits. Furthermore, it also helps investors become comfortable with taking risks and making decisions based on reliable data rather than guesswork or gut instinct alone.

Practical Take-Aways for Progressive Exposure

💭 MARK’S 5 THINKING PRINCIPLES

While Mark Minervini has not given hard rules about Progressive exposure he has identified five thinking principles in order to use progressive exposure effectively:

Start small – when starting from cash begin with smaller positions until you get an understanding of how easy the markets moves. Small success leads to big success;

Increase size only when there’s a traction in you trading – only increase your position size when there’s a clear evidence that your trading style is working will allow winning trades to finance larger trades.

Respect stops – always have predetermined stops in place;

Scale back when trading poor – make sure you have rules that is optimised to manage your risk when you perform badly;

Use leverage judiciously – use leverage cautiously since it carries more risk than regular trades. If you are not trading well at 25% or 50% there is no reason to bump exposure to 75%, 100% or margin.

🧮 EXAMPLE OF PROGRESSIVE EXPOSURE

Here is an example of how Progressive exposure allows new traders to increase size when things are working.

In Trade 1, the trade is a quarter position size. Selling it as a winner, they can determine that the stock market is suitable to apply more risk.

For Trade 2 he increases trade size to Half position size. Closing it as a winner, the trader has now $3,000 as a running profit in order to test another increase in position size.

The trader he has now financed a full position size loser as Trade 3 and a half position size loser Trade 4.

All of this is additionally reinforced due to the 2:1 Reward:Risk profile of the trader.

A more complex examples shows that if Trade 3 in the previous example was a Full position size winner, the trader would have financed 3 Full Position size losers (Trade 4, 5 and 6) and Half size loser (Trade 7).

Advantages and Limitations of Progressive Exposure

👍 ADVANTAGES OF PROGRESIVE EXPOSURE

One of the major advantages of progressive exposure is that it gives traders an opportunity to manage their risk without subjecting themselves to too much volatility. This way, if there is a sudden move against their position, they would not be exposed to large losses as they would not have invested too much capital yet.

Another advantage of progressive exposure is that it allows traders to take on bigger positions as they gain more experience and understanding of the markets. They can slowly increase their positions while maintaining good risk management practices, thus allowing them to benefit from larger moves in the market and potentially achieve greater returns than if they had taken on larger positions all at once.

👎 LIMITATIONS OF PROGRESIVE EXPOSURE

While progressive exposure has many benefits, there are some limitations associated with this strategy as well.

One limitation is that it takes longer for the trader to build up their position size compared to other strategies, such as scalping or day trading where traders take on large positions almost immediately after entering the market. This means that trades may miss out on some potential opportunities due to slow accumulation times when using progressive exposure.

Another limitation is that since this strategy relies heavily on risk management practices and controlling emotions while trading, inexperienced traders are more likely to struggle when implementing this approach correctly than experienced traders who have already developed good risk management habits and emotional control when making trading decisions.

🎁 My Progressive Exposure Rules

Especially when coming out of a bear market it is key to nail down your position sizing and fully exploit the Progressive Exposure logic.

I have created a system that has helped many trading friends to properly exploit the system.

TRADING ASSUMPTIONS

Portfolio size: $100,000

Full position size: $25,000 (25%)

Long term average stop loss: 6% from Position size

Long term average win: 12% from Position size

Trader style: 2:1 Breakout trader

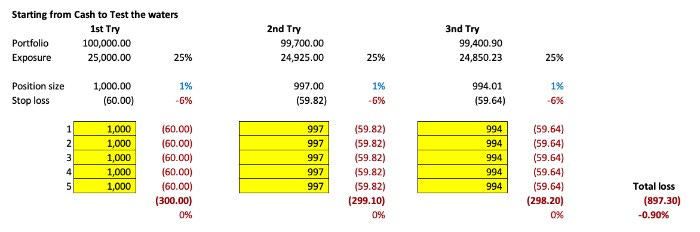

👉 SCENARIO 1 - THE 3 TRY TESTING SYSTEM

The rules prohibit you start with full position size when you are starting from cash. Usually I am cash when the conditions have proved highly unfavorable for my trading style.

I trade in batches of 5 trades, starting with microscopic positions. The tiny position size do NOT aim to make me money but to test the waters and keep me engaged in the market.

❗️Rule 1: If my last 5 trades have all been losers I will halt trading for a few days and will not increase position size.

Here is an example how I might try 3 times to test the waters in a short period of time with 15 consecutive losses. The rules protect my account as I would lose less than 1% of my total capital in the process of 15 trades.

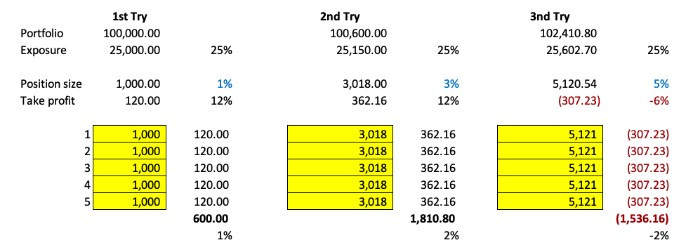

👉 SCENARIO 2 - MOVING FROM CASH TO FULL POSITION SIZE

I would again start with a batch of 5 trades. There are 2 conditions:

For the increasing of position size, I would look to grab at least 5 winners in my 15 trades. This comes for a win rate of +30%.

The second condition that is required is that the average size of the winners has to be close to my long term winning average of 12%. This is important as it is a protection mechanism if things do not continue to work in my favour.

❗️Rule 2: I require to close at least 5 winners in my last 15 trades in order to increase my exposure. The size of the winners also has to be close to my long term trading average.

Here is an example. I would be slower and I would need 6 tries to get to full position size. However, even within the first 3 tries, I gather nearly 5.5% compared to the -0.9% loss in case I am wrong.

Mark Minervini advises - "Always get odds on your money"

👉 SCENARIO 3: THE CHOP FEST

The chop fest scenario occurs when within the exposure journey, things suddenly stop working and you need to start scaling down before you have reached full exposure status. Here the style of 2:1 trading is what protect us. You can see in the example below, at the 3rd try when we use the largest 5% position size, we have already gathered enough running PL within 2nd try to cover 5 consecutive 5% loses losses without loosing any money ($-1,536 vs. $1,810).

❗️Rule 3: Combine Rule 1 and Rule 2. If within your run you start getting multiple consecutive losers, start decreasing exposure.

MAKE IT YOURS

If you like the above logic, you can improve your performance, using the above concepts to make the rules yours. For instance for Rule 1, change the number of trades from 5 to 3. For Rule 2, start with 5% or 6.25% (quarter size) directly, as well as require less winners (e.g 3 winners within last 6 trades).

Conclusion

Overall, Progressive Exposure is an effective strategy for new investors who want to minimize losses because it reduces overall portfolio volatility while still offering potential profit opportunities over time as traders gain more experience and confidence in their skillset. It's an excellent tool for those looking to become successful at trading without exposing themselves too much initially - allowing them to dip their toes into the waters safely before diving deeper later on.

Hey Mayur! Thank you for the question. I am not sure exactly what you are asking but let me explain. I think you are thinking about it in the wrong way. I will explain, but if you are looking to get a formula, I have created the position sizing indicator (FREE) for my readers:

https://www.tradingview.com/script/CzuirQGx-TTI-Position-Sizing-Calculator/

So I explain.

Account Size = $100k

Full position size = $25k

Stop loss = 6% from Position size, 6% from $25k = $1,500

You mention at the beginning 1% Position size. This is very very little and very limiting. The methodology that I use and the methodology that has been taught by the Market Wizards is that you need to concentrate in the big winners. If you have 1% Position size thisi is too low.

However, what I think you are confusing is Risk to Total Equity with Position Size. The Risk to Total Equity (ROTE) is how much of the Account size ($100k) are you risking in the trade. When you have a Full position size ($25k) and Stop Loss of 6% ($1,500), your ROTE is $1,500/100.000 = 1.5%.

So if you follow the methodology described in my articles, you would buy $25k worth of XYZ Inc stock. This is 89 shares (25k/280). Your SL is (let's assume) 6% (read article on how to determine stop loss in my newsletter - https://tintintrading.substack.com/p/how-to-open-a-trade-workflow). 6%. * 280 price per share * 89 shares = $1,500, which is 1.5% ROTE.

What we are addressing in the article is how to change the Position size (25%) based on the way your recent trading has been going on. So instead of risking 1.5% ROTE decrease the risk until things work your way.

If you have more questions or want to chat make sure to connect to my discord.

Great job, can you share the excel file?

saeed-909-07@hotmail.com