Scanning for stocks using my stocks screening criteria

Free stock screener resources included - links and references to over 30 scanners

Key Takeaways

Stock screening should be part of the daily routine of traders and investors.

Access over 30 of my actual scans / stock screeners in section Best tools for stock screeners

Stock Scanners are to be used daily and separated into Deep and Shallow scans to find

The best stock has both technical and fundamental criteria

Develop skills to review stocks quickly (tips available)

Choose tools and multiple filters which fit your style (6 different trading tools reviewed)

Disclaimer: Some articles use the term "scanners" others use the term "screeners". I will use them interchangeably here, so do not get confused. The principles are the same across all the platforms and are key to find the best stock ideas.

Table of Contents

SECTION 1. What is Stock Screening and how to use it?

SECTION 2. When should you scan for stocks?

SECTION 3. Best parameters for best stocks

SECTION 4. Example of getting stock idea

SECTION 5. Best Screeners Reviewed

• MarketSmith

• FinViz

• ThinkorSwim

• StockCharts.com

• TradingView

• BoomTraders Scanner

SECTION 6. Kitchen SinkWhat is Stock Screening and how to use it to find Trade Ideas?

In one sentence it is a method to answer the question

"Which stocks do X?", where "X" is defined by your trading strategy.

Stock Screening is a super effective method that enables you to use particular data points to identify the best stocks for your trading objectives. Many times it is the first point where we find trade ideas and discover top performing stocks. Many stock screening tools give you access to a large databases of fundamental and technical measures that are intended to identify possible investments based on your chosen parameters. Stock screeners can be deployed by traders using technical analysis and fundamental analysis, as well as those using day trading and swing trading.

When should you scan for stocks?

My routine involves two types of scans, and since I am a scuba diver I use an analogy from diving. These are Deep Dives and Shallow Dives. The Deep Dive is the one screener I do over the weekends. The Shallow Dives are the ones I do during the weekdays.

Deep Dive Scanners - weekend

STEP 1 - REVIEW THE SCREENERS

I go over nearly 100 stock scanners and review over 1000 stock charts every weekend (Do not be intimidated, look at the Screening Tips to see how to speed up the process). I know finding the best stock leaders requires exposure. I pick the stocks which have the "look" (this we have started to cover in the Base Anatomy Series). I note them in Excel, Scrap paper or Notes on Mac. I note down which stock screener did I pick them from. Here is a messy extract from my little notebook.

STEP 2 - LOOK FOR PATTERNS

Here I look for any emerging patterns. This is definitely more of an art than a checklist but here are some examples to get an idea:

Do I see a particular industry group or sector?

Any predominant technical criteria for the setup like High Tight Flags?

How many stocks do I find - are we thin or thick on numbers?

What Stage (as per Stan Weinstein criteria) are most of the stocks I like?

STEP 3 - CLEAN THE LIST AND SORT IT

Final step is to sort the stocks into categories. I use a 3 setup category from stock scanners and add 2 more setup categories based on my trading (in total I end up with a finished Watchlist of 5 categories). These are:

Open Positions (non stock screener - based on trading)

Recently Closed Positions (non stock screener - based on trading)

Focus List - nearly complete setups (aka the best stock ideas) that are nearly ready and I can take in the upcoming week (stock screener section)

High On Deck - setups that have started to form a right side but need more time to look complete (stock screener section)

Extended - Recent breakouts that are not tradable but good to watch how they perform - do breakouts hold or do they drop (stock screener section)

Shallow Dive Scanners - weekday

The shallow dive includes looking over less than 10 stock screeners. The ones I pick are dependent on the recent action in the stock market. As of writing this piece, the market has been over 6 months in a bear market and the best trade ideas come from stocks that show impressive Relative Strength compared to the market.

There are also a few Study scanners that I look for time and time again. These are stock screeners that are not used for idea generation, but for educational purposes. I want to see the stocks that are making impressive moves. Example, is the stocks that have moves +20% in the last 5 days. Usually William O'Neil, has a rule that if a stock advances +20% in less than 15 days it should be held for at least 8 weeks (some posts on buy and sell rules here) These let me be on the pulse of potential leaders (typical setups are High Tight Flags or Power Plays - read more here).

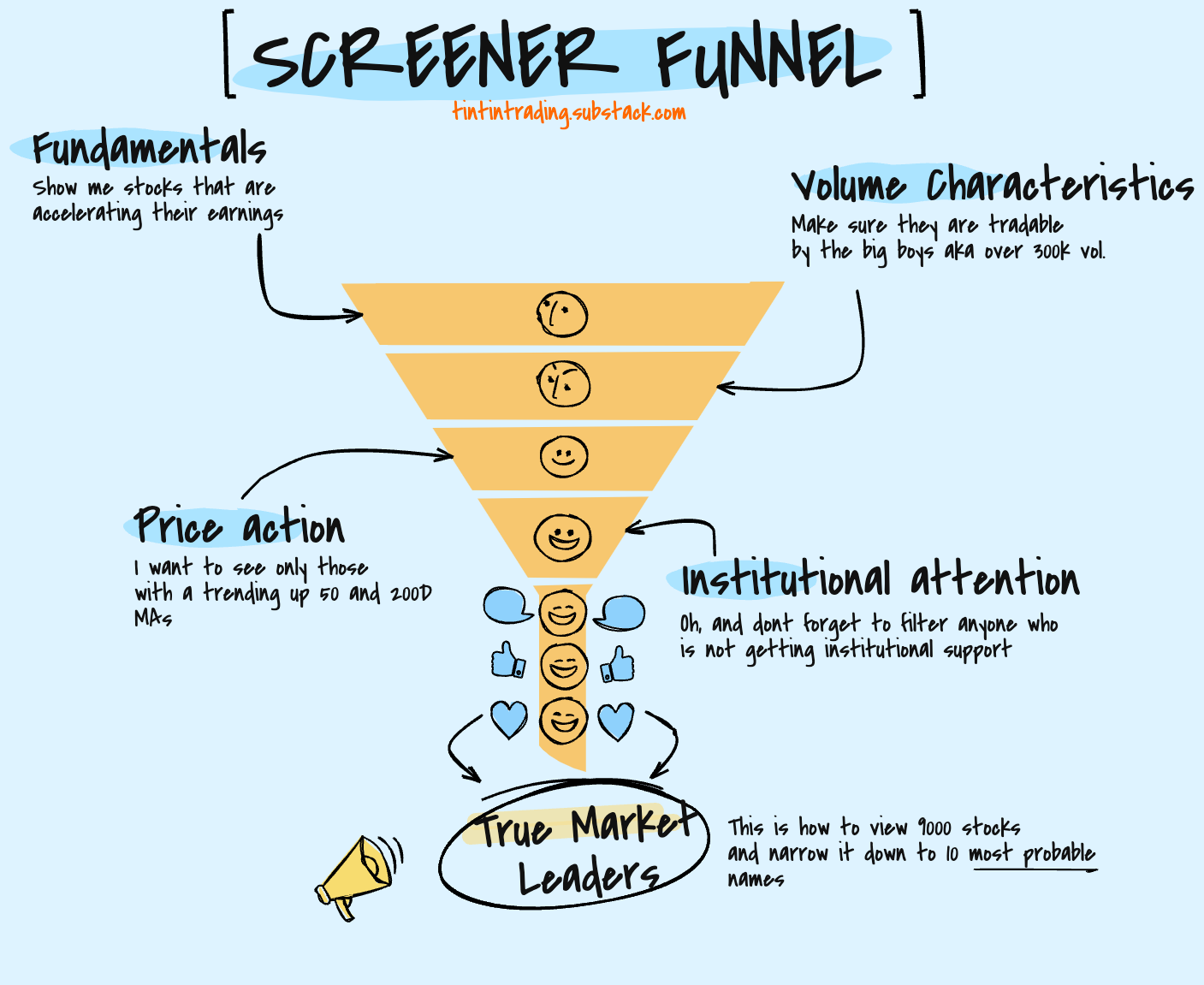

Best stock screeners parameters for the best stock trade ideas (as per my opinion)

Some of the criteria that give me great confidence in a stock includes both technical and fundamental criteria.

TECHNICAL ANALYSIS CRITERIA

Price is above the 50 Day Moving Average (50D MA is trending up)

Price is above the 200 Day Moving Average (200D MA is trending up)

Price is above $10

RS Rating (in MarketSmith) is over 92

Industry Rating (in MarketSmith or Equivalent) is in top 50 performing industries

FUNDAMENTAL ANALYSIS CRITERIA

Trading volume over 300k shares per day (based on 50 Day Moving average of volume)

EPS has been accelerating over the last 3 Quarters

IPO date is within last 10 years

Market Cap over $5 billion

From then on, I look at type of a base, base characteristics, volume patterns, volatility, pivot points and I plan the trade.

Getting trade ideas from stock screener EXAMPLE

In order to generate ideas, you ought to find the right stock screeners for your type of trading. For instance value investors might care little to a swing traders scanner. Day trading stock scanner will have little value for position traders. But do not be discouraged, most tools are so versatile that can be used for any style. I trade using short swing trading breakout methodology, inspired very much by Mark Minervini, Mark Ritchie II and William O'Neil.

Here is an example, of what I do to get best stock ideas. I would start my sessions running the Marketsmith 250 screener and the sorted by RS Rating, as my first most important metric. I started quickly scrolling (I usually take less than 1 second per chart to know if it has the "umph" or not) and found a stock that I like which is $VRTX. This stock is showing great structure and contextual strength. I note it down in my notebook as the Step 1 stock - reviewed from a stock screener.

Below I added the full print of the stock, as an example

P.S Getting to being fast on screening stocks is about training your eyes. Do not rush but do not be looking to justify that the stock is good.

Screening tips when reviewing trade ideas

My weekend work takes anywhere between 45 mins to 1 hour and 30 mins. The time is long because of documenting the process, nothing else. That being said, here are some tips for speeding up your screening process:

Look at the trading volume first before looking at price action - this might be counter intuitive but if you do not see the necessary volume confirmation just skip the stock

Limit yourself to no more than 5 seconds per stock - my point is that I look at technicals first and then I do the fundamental due diligence these are necessary to find the best stock (one or more).

Look at the weekly chart - this helps minimize noise and will give you a clearer picture if there is a base and if it is sound

Study past winners and past performers (I am redesigning my models books and can issue them for anyone interested just DM me on Twitter)

Best stock screeners that traders need

MarketSmith.com - Best advanced stock screener

MarketSmith is the premium retail product from Investors Business Daily. The screener is really high quality and it is my go-to-tool for daily and weekly screening. The screener has institutional-level criteria that are not available in any of the other products. I love MarketSmith and hence why I put it on place #1 of my list. MarketSmith can filter in up to 8 categories:

MarketSmith Proprietary Ratings (EPS Rating, RS Rating, Industry Rating, SMR Rating, Acc/Dis Rating)

Earnings

Sales

Industry & Sectors

Shares & Holdings

Price & Volume

Margins & Ratios

General

Some Stock screen tips recommended from David Ryan (link) :

Applicable for swing trading methods.

Start with MarketSmith 250 every weekend.

Sort by Group Rank - this shows the best stocks in the best groups.

Look for the best stock in the best group - Does it have a base? Is it buyable?

Review the 195 Industry Group Scans weekly to identify where the next leaders might come up from - look for the top 50 groups for the current week .

Look at the Mark Minervini Trend Templates for leaders early in their moves.

MY MARKETSMITH SCREENERS (some):

I have over 50 custom stock screeners in MarketSmith. For the interest of focus, I will share my IPO screening criteria here. IPO screeners are based and inspired on the book "Lifecycle Trader" from Kathy Donnolley - I highly recommend the book (link)! The books is great for swing traders wanting to up their game by trading IPOs.

IPO screeners

IPO Alert

IPO Rare Jewel

IPO Liquidity Matters

IPO Lifecycle Trader

IPO Near Highs

Finviz.com - Best free stock screener

Finviz is a place to get free stock ideas. The basic free version gives 90% of the value of the webiste. I am a premium members to get some small additional features (just because lol) but the free version will do the job for you. If you want to subscribe to FinViz using this link and get 15% DISCOUNT OFF the FINVIZ*Elite membership. Details in section Kitchen Sink in the bottom of this article.

MY FINVIZ SCREENERS:

General stock Screener

stock Screener based on Mark Minervini criteria

stock Screener based on Quallamggie criteria

stock Screener based on Oliver Kell criteria

Again, these are applicable for swing trading methods.

Thinkorswim - Best stock screener for indicator geeks

The really powerful feature in Thinkroswim is scanning by customer indicators. This means that if you are proficient to build your own script, or just buy a script from the community (here is our store). I have coded a lot of the criteria I want to see and have automated the stock screener process with regular email notifications (if you want to learn more about this DM me on Twitter). I have over 85 stock scanners that I use here in various categories but mostly based on premium indicators that I have built or bought. I will share a few for stock screeners from my universe:

MY THINKORSWIM STOCK SCREENERS:

Accumulation to Acceleration - http://tos.mx/LdgWK0B

Distribution to Deceleration - http://tos.mx/OqvcUWX

3 of 5 bars with +3 Standard Deviation higher stock volume - http://tos.mx/zLU1MhN

Stock screener with +4 Standard Deviation higher volume - http://tos.mx/o59gbjk

Stock screener for 50SMA & 200SMA with unusual volume - http://tos.mx/PHP0RhC

StockCharts.comScreener - Best stock screener for crypto

I like Stock Charts for 2 main reasons . Can code personal screeners and also and use those screeners for crypto (more on crypto in future edition of this post). I have further automated my stock scans to arrive daily in my inbox so that I do not miss anything important and ease my trading. Below are a few examples.

MY STOCK CHARTS STOCK SCREENERS:

General stock Screeners

+20% in a single week

[type = stock] and [country = US] and [[today's Close - 5 days ago Close]*100/[5 days ago Close] >= 20] and [group is not ETF] and [exchange != PINK]

Cup and Handle Breakout

[type = stock] and [country is US] and [SMA(200,volume) > 400,000] and [exchange != PINK] and [group IS NOT ETF] and [close > Upper Price Chan(20)] and [close > Upper Price Chan(50)] and [Upper Price Chan(20) = 5 days ago Upper Price Chan(20)] and [SMA(150) > yesterdays SMA(150)] and [Close > 5]

Volume Daily is 2x minimum

[type is stock] and [country = US] and [Daily Close > Yesterdays Daily Close] and [Daily SMA(10,Daily Close) > Yesterdays Daily SMA(10,Daily Close)] and [volume > sma(200, volume) * 2] and [exchange != PINK] and [Daily SMA(200,Daily Volume) > 400000] and [group is not ETF] and [Close > 5]

TradingView Screeners - Good stock screener for crypto

Subscribe to TradingView using this link and get $30 towards your chosen plan. While I love the TradingView platform and it is my main charting platform the stock screener is very lagging behind. I would probably use this stock screener very rarely and only for the crypto space (more in future post for this).

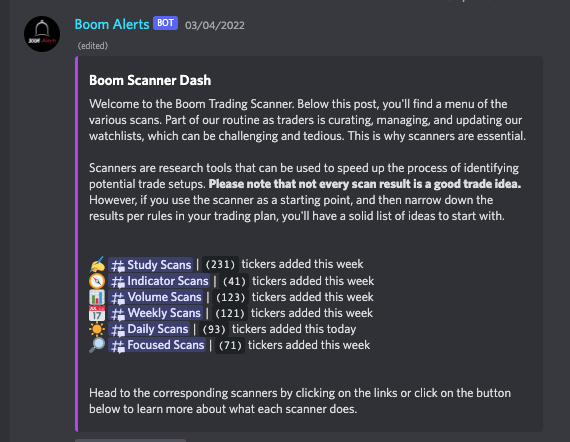

BOOM Discord Screeners - Best place to get all the stock screeners above

We have automated our trading and siloed much of these criteria into one place, called the BOOM Scanners channel. In our BOOM Discord Server, premium members (there is free trial too and you get a month of free stock ideas amongst other goodies) can access stocks scanners into 6 categories. There are detailed instructions for each stock screener:

Study Scans - stock scanners aimed for daily studies

Indicator Scans - stock scanners that look for particular patterns indicator patterns

Volume Scans - stock scanners that are based on volume characteristics

Weekly Scans - stock screeners that are concentrated for weekly review

Daily Scans - stock scanners that are recommended for daily use

Focused Scans - stock screeners concentrated on momentum only

Next lesson: Crypto Screeners (if you vote it)

Crypto is aZ whole new universe of setups and tools for screening and I would love to share them with you, but only if you want it.

The kitchen sink 🚰

Affiliate Details

FINVIZ - Basically if you subscribe with the provided link, I would receive 30% commission off the subscription price on all subsequent subscriptions (details of the FINVIZ program here). The proposition is simple - I will give you back 15% of the 30% I receive. Make sure you read all the rules in the link, since I will only pay back after I get paid. I can pay you through PayPal or Stripe. Message me if you have questions.

Thank you!

💡These posts consume most of my Sundays! If you have received value:

Share it on Twitter (using the button below)

Subscribe to the newsletter.

This way you will help grow the community together!