Know the rules so well, so you can break them effectively. - Dalai Lama XIV

Table of Contents

Introduction

The Importance of Trading Rules

Foundational Trading Rules for Newbies

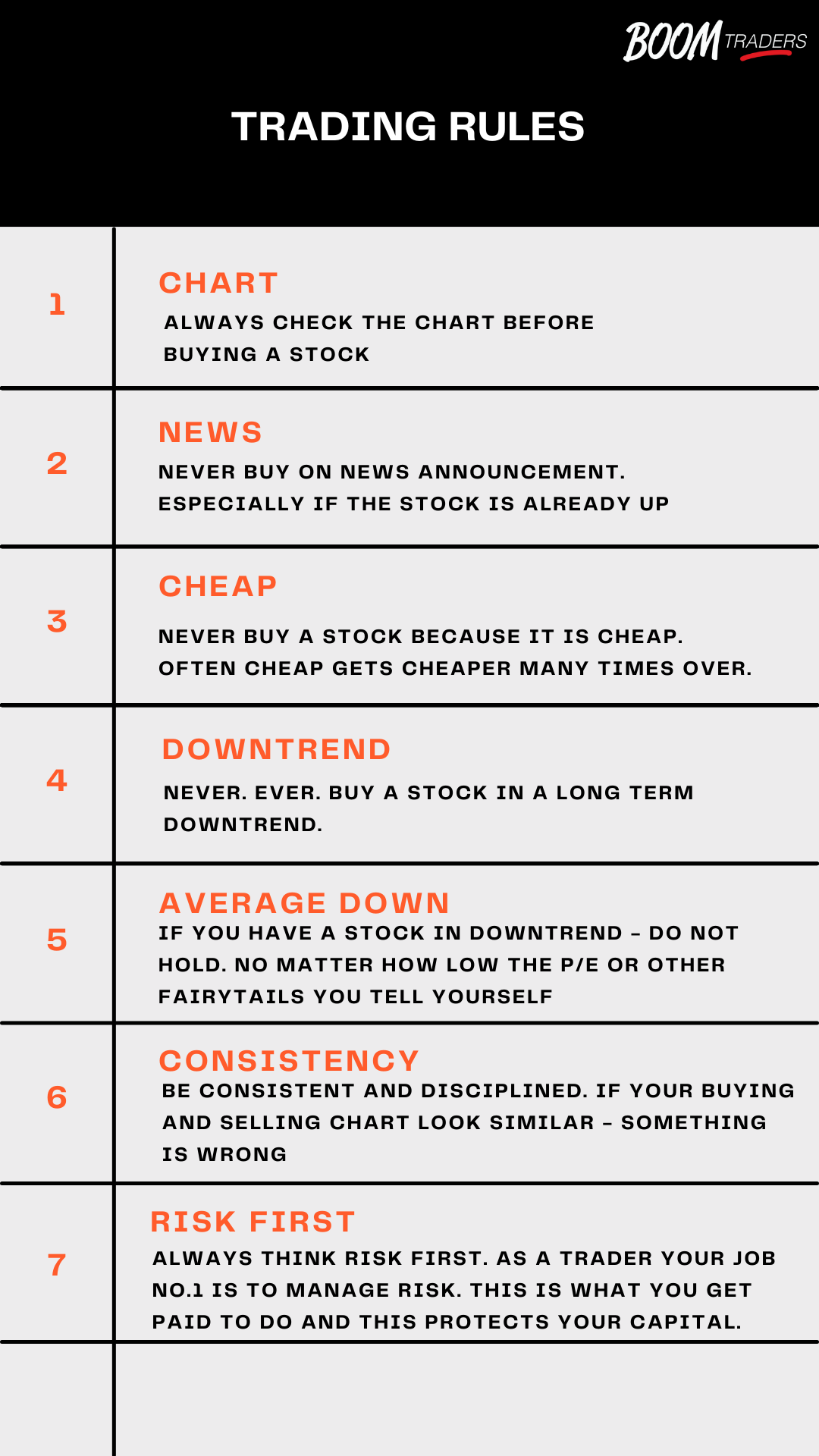

a. Rule #1: Check the Chart Before Buying a Stock

b. Rule #2: Never Buy on News Announcement, Especially if the Stock is Already Up

c. Rule #3: Never Buy a Stock Because it is Cheap

d. Rule #4: Never Buy a Stock in a Long-term Downtrend

e. Rule #5: Do Not Average Down on a Stock in Downtrend

f. Rule #6: Be Consistent and Disciplined

g. Rule #7: Always Think Risk First

Conclusion👋Introduction

And while this is not a Fight Club (for those seen the movie 🎬), rules are very important for traders. The simple reason is that unlike other professions where there are high obstacles before you start practicing (education, certification, minimum supervised practice you name it), in trading you need a phone and internet connection and you are lock’n’loaded son! Furthermore, in retail trading…it is really a You vs. You fight. This sometimes makes it relatively easy to persuade your opponent into your line of thinking.

💁Importance of Trading Rules

This is also the reason for the high mortality rate among traders. Sorry to break it to you but STATISTICALLY you ain’t gonna make money trading. Now it is your go to prove me wrong 😉

And so, lo and behold, below is the list of simple trading rules that are here to tilt the scales in your favour. As Tesco says “every little helps” . These are not the standard rules you read on Fintwit (I will reserve those for a deeper dive into technical rules, buy and sell techniques), but these are really the foundational rules I would like to share with those of you starting out in the business. And to remind them to those that are already veterans with a few scars on their back.

Of course, a disclaimer is due, since the beauty of trading is that it doesn’t have a right answer. These are only the things that have helped me and my methodology over the years. If you have similar understanding about the market like me - these will help (check them in the About section). Enjoy!

⛺️Foundational Trading Rules for Newbies

📈Rule #1: Check the Chart Before Buying a Stock

The first and most important rule is to check the chart before buying a stock. The chart will help you identify the trends and patterns in the stock's price history. This information is crucial in determining whether to buy, sell or hold a stock. This in essence says - learn technical analysis. There are a few basic principles that will carry you a long way. I suggest you start by identifying proper bases. I have started a series around that and you can read about the highest probability base here.

🗞️Rule #2: Never Buy on News Announcement, Especially if the Stock is Already Up

It is crucial to avoid buying a stock based on news announcements, especially if the stock is already up. In many cases, the price increase is temporary and does not reflect the long-term prospects of the company. Always wait for the right opportunity and let the market settle down before making any buying decisions. The market is forward looking mechanism - this means that many times the news are already baked into the cake - understanding this is going to push up right at the top of the traders out there.

🤑Rule #3: Never Buy a Stock Because it is Cheap

The third rule is to never buy a stock just because it is cheap. Often, cheap stocks get cheaper many times over. Instead, focus on the value and potential of the stock, as these factors are more likely to drive long-term gains. The stock price is driven by the crowd (and more concretely the institutional investors) - you want to jump the and ride the hype and not second guess where the hype is coming at <– this of course is metaphor for the case of breakout trading /I do not suggest you should ever buy extended stocks/.

↘️Rule #4: Never Buy a Stock in a Long-term Downtrend

It is essential to avoid buying a stock in a long-term downtrend. Stocks in downtrends tend to continue in that direction and may not recover, leading to significant losses. It is always better to wait for a reversal of the trend before considering buying the stock. Why? Because of a the concept of an overhead supply. This literally means there are traders, investors and funds that are holding the stock at a higher price than you. They have experienced /given the long term downtrend/ a significant loss and hence pain. They can’t wait for the stock to pop up in order to ‘get out at break-even’. You buying the lowest price is exactly the demand they look for to offload their load. In other words, you are going agains a massive crowd of people who will likely play against you.

📉Rule #5: Do Not Average Down on a Stock in Downtrend

If you have a stock in downtrend, it is best not to hold it, no matter how low the price-to-earnings ratio or other metrics seem. This is because stocks in downtrends tend to continue in that direction and may not recover, leading to significant losses. Do not try to average down by buying more shares in the hope of reducing your average cost. Making losses small is one of the key edges a trader can have. Read more about it here:

📐Rule #6: Be Consistent and Disciplined

Being consistent and disciplined is crucial in trading. If your buying and selling charts look similar, something is wrong. Stick to your strategy, and do not let emotions cloud your judgement. Strategy drift is one of the more common trait of failed traders - stick to one thing and make it work.

🧠Rule #7: Always Think Risk First

As a trader, your job number one is to manage risk. Always think risk first and prioritize risk management above all else. This will help protect your capital and ensure that you stay in the game for the long term. Keep in mind that the market is unpredictable, and losses are a part of the game. However, by prioritizing risk management, you can minimize losses and maximize gains. There is a deep-dive article I have written about how to manage risk, and I include this a lot in my newsletter - this is job #1 - if you read one thing read this: link.

Conclusion

In conclusion, trading can be a challenging and unpredictable venture, but having a set of rules can make all the difference. The foundational trading rules discussed above will help newbies navigate the market with ease and avoid some common pitfalls. Remember to always prioritize risk management and be consistent and disciplined in your trading strategy. With these rules in mind, you will be well on your way to success in the world of trading.

By the way - if you want to talk to us about anything trading and learn more - jump over to the Discord community 👇