Why Oil stocks are best pick now? + How to use Relative Strength

Examples and techniques disclosed below

Table of Contents:

1. What are the Oil stocks?

2. How do we define best?

3. 7 Best Oil stocks to watchExecutive Summary:

In this piece, I will show you why I like oil stocks in the stock market now and explain the exact technique I use to find the trending pockets in the market. Hopefully, you will grab some good stocks to watch but also learn a few new techniques about how to find those in the future on your own. Key points:

Oil Stocks are a subgroup of the Energy Sector

We define the best stocks based on a swing trading breakout methodology

The tool to gauge best stocks is Relative Strength

We look at 3 techniques for Relative Strength (tools and links included)

7 best stock we review:

What are the Oil Stocks?

Oil stocks refers to a segment of stocks within the Energy sector. In other words it is in the business of production or sale of energy products. Further on the sector can be separated into renewable energy sources and non-renewable energy sources. Oil companies are part of the non-renewable energy sources. Companies within segment can be both upstream companies like exploration firms or downstream companies like oil refineries.

Below you can see how the 342 Energy stocks in the MarketSmith database separate in Industries. As you can see Oil and Gas industry stocks dominates the sector (about 80% of all stocks).

How do we define the best?

In order to define the best oil stocks worth buying its good to give some assumption disclaimers first (since this "the best" is very personal definition):

Assumption 1: I trade/invest using a CAN SLIM, breakout methodology (in simple words I buy stocks breaking out from bases near their highs with proper fundamental characteristics:

Assumption 2: The "best" is viewed from a swing trading timeframe. This means that I do not day trade, nor do I make long term investments (the type get it and forget it stocks), rather my timeframe is anywhere from 5 days to 2-3 months (my average winners are held for 2 weeks and my average losers are closed within 5 days).

Assumption 3: Institutional support (aka large funds buying stocks) is a major clue that I follow when trading the stock market.

So with that in mind let's dive into the rabbit hole.

So do we just look at the rising oil prices and determine that it is good to buy now? Well, I would not recommend. Rather I use the single most powerful tool for the above mentioned methodology. This is the Relative Strength.

Here is how we define Relative Strength:

The relative strength is the comparison of a stock's performance against the performance of another asset or basket of assets. For example, this can be the price performance in a given period against the price performance of a major market average like S&P500.

One of the biggest tale tales of the bear markets is that it, during a bear market it is easier than ever to find the most bullish stocks to buy, since the support of Institutions (assumption 3) shows though a strong Relative Strength. The general idea here is that when a stock starts to sell off, institutions who have a longer term timeframe (+1 year) look to establish positions in the stock while it is being sold by weaker hands retail investors. This type of hands turnover can be viewed by the best performing stocks.

Now back to buying oil stocks. I am going to show you a few techniques using Relative Strength to find True Market Leaders (TMLs) and especially why I am picking oil stocks now. Keep on reading.

Technique 1 - Sector Relative Strength

While I employ a bottom up approach (stock ➡ industry ➡ sector ➡ market) in my trading, validating the pockets of the market that are worth trading at any given point is often validated by a top down approach (market ➡ sector ➡ industry ➡ stocks) too.

Here is the top down approach. It is very simple. I look at the 1 year relative performance of the sectors. I use the FinViz free tool (link here if you want to bookmark it), and look at the Half Year Relative Performance and the 1 Year Relative Performance. I use the default settings (Sectors & Bar charts). As you see below the 1 year performance is the strongest in the Energy stocks.

Technique 2 - Industry Relative Strength

Step 2.1 - Finviz

From then on, I dive deeper into the sector Energy. I continue on the FinViz but change the Group setting to the desired industry. I lower the timeframe that I watch to 1 month Relative Strength and 1 Week Relative Strength. Here is a link. Our discover continues with Oil industry dominating the recent outperformance. Apart from oil, we start to see names like natural gas, coal, uranium and drilling. Now since this is a moment in time analysis (I like to dig deeper and use the second tool explained below).

Step 2.2 - Custom Excel tool + MarketSmith

The second tool I use is Custom Excel chart analysis from data sourced from MarketSmith. MarketSmith has this Screen List under menu Markets/197 Industry Groups. The screen result sorts the 197 Industry Groups based on their relative strength for the current week, the 3 month average and 6 month average, so I source the data from there directly.

After inputing the data into the Excel tool, I have a very powerful view of the market. The tool has +90 different criteria's that analyse the industries for any way I like.

For anyone subscribed type in "Excel tool please" below in the comments and I will send you this Excel tool via mail. Here is a preview (remember it would require weekly input from MarketSmith, which I can also help with).

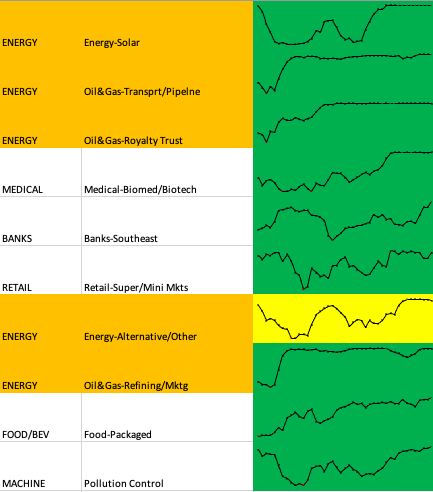

I first look at the 1 Week Relative Performance. So when sorting the industries, I see that within the top 10 industries, nearly half (5) are in the oil industry. The Sparkline (third column) denominates the Relative Strength line for the past year (see below).

I then start to fidget with the tool to validate or reject my hypothesis that oil stocks are best picks right now. The screenshot below shows the same data but sorted for the 3 month Relative Strength performance. Again I see a mostly Oil and gas industry stocks in the top 10.

Further on, I can see how many of those stocks are in the legendary IBD MarketSmith Growth 250 list (these are the top 250 stocks in the market at any given moment). I see that 44 (nearly 20% of stocks there are energy stocks), or where has been the largest 1 week strength improvement or which is the largest industry in the top 10 industries.

Few words of caution!!

Oil companies are already hot - As we see the energy stocks have been hot for the whole year - a common mistake amongst new traders is to jump on a trend too late. Hence chasing industries but jumping on laggard stocks which have lower probability of succeed in (we are going to filter this with technique 3).

Many but less than last week - From the excel sheet, while we see a good saturation of oil stock candidates, we can also see that there has been a bunch of stocks that have fallen of the IBD Growth 250 list (currently they are 44 but last week they were 57!).

Cyclical and seasonal - Oil stocks, gas exploration stocks, commodities stock have the reputation of being very cyclical and prone to seasonalities. This means they move along with the economic cycle (booms and recessions) and are in high demand during particular times of the year. All of this means that there is lower probability (not impossible) to find the next bull market leaders here.

News and price shocks - There has been a lot of news related signals that might have contributed to the concentrated investor interest in oil companies. Namely the raise of gas prices and crude oil prices. The international conflict with Russia's invasion of Ukraine, which builds for an energy crisis in the EU. Heated discussions with petroleum exporting countries and post COVID-19 increase in oil demand.

That being said I do follow the stocks first and if they set up, I buy them. This is a little wisdom I have learned from Mark Minervini and it has worked wonders.

Technique 3 - Stock Relative Strength

Now if you are equipped with MarketSmith this is very easy since you get a Relative Strength score from 1 to 99 for the individual strength of the stock (similar to the industries Relative strength we look for top 10% of the stocks in the market).

Marketsmith Relative Strength type formula

Now if you do not have MarketSmith here you can find an IBD style Relative Strength Formula, so that you can use that in your own scanners (or at least something similar). Here are some ideas that you can work from:

RS number is the percentile sorting of the Relative Strength formula. Basically the score of each of the +9000 stocks is compared. A score of 99 means that this stock outperforms 99% of all the other stocks on the market

IBD style Relative Strength formula = (63 days close change * weight of 2x) + (126 days close change) + (189 days close change) + (252 days close change).

63 days = 1 quarter

126 days = 2 quarters

189 days = 3 quarters

252 days = 4 quarters

Important point! Do not confuse the RS Rating with the RS line! The RS Rating is explained above. The RS line is the relative price change against a market average index, most commonly the S&P500 or Nasdaq Composite. A simple formula for the RS line is (Today's close/S&P500close).

Step 3.1. Marketsmith IBD Growth 250 list

I would usually take the IBD MarketSmith Growth 250 list and look at the Energy stocks within it. I would sort them by the RS rating in IBD in order to see which are the best of the best stocks (go check out this link, section Best stock screener parameters for the best stock trade ideas).

I look for specific fundamental (covered some here) and technical checklist (a full discussion topic of a following article), but a really high overview would be to say that I look for stocks with RS rating over 90 that are in constructive bases (check out the Anatomy series to find what a proper base looks like. Here is an example of the Cup and Handle).

Step 3.2. Industry constitutes

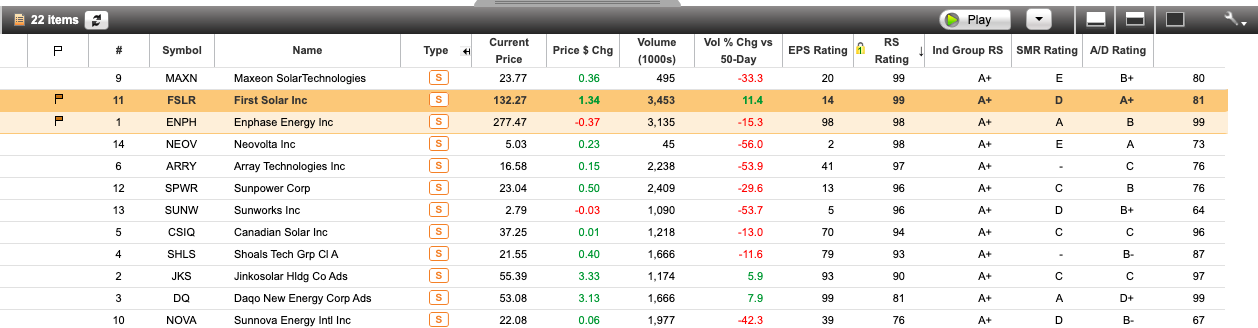

I also go on and open each of the top industries identified in Technique 2 and see what stocks make up that industry. I look to see the best (fundamentally and technically) stocks within this industry. For example, when I open the Energy-Solar industry I find 22 names. I cut off all stocks with RS rating below 90. I then look for stocks in Stage 2 (a separate lesson for this will be given out) that are having a good A/D Rating (A/D rating measures how supported by institutions is the stock - remember Assumption 3?). Example below.

7 Best oil stocks to watch now

After going through the process above I filtered the following 9 stocks as ones that I would like to keep close and watch for potential breakout (breakout rules will be bundled in a future article for how to pick stocks). Here is the list.

A BIG disclaimer! I am waiting for a Rally Day and Follow Through Day in order to start making positions in the market. Before this occurs all of these stocks will be making their way into may watchlist. Also before we begin, you might find it interesting to check out the 7 minute video of how stocks bottom:

FSLR 0.00%↑ - not an oil stock but good pick from the Energy Sector

FSLR is a solar name that manufactures and sells solar modules doe residential and commercial markets in EU, US and ASIA. The base formation is the Power Play or the High Tight Flag (explained here). There is a strong outperformance on the RS Line (indicated by the purple dots too) and great volume prints. I have noted the pivot point I want to see being broken out of in order to position myself here

Now if you see the fundamentals of FSLR are quite poor, but if you have read the Power Play article - this is not a problem. When we have big advance of over +100% and near to no profit taking we can conclude that this is being picked up by institutions.

STNG 0.00%↑

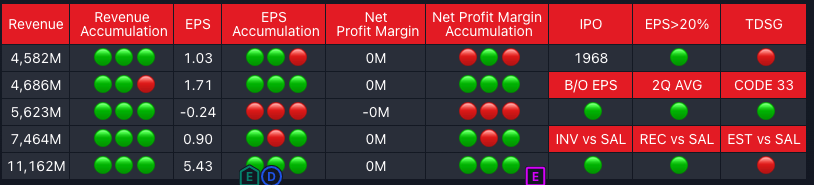

STNG is from the Oil and Gas Transport/Pipeline industry. It provides seaborne transportation services for crude oil and petroleum products. Currently the stock is forming a 3rd stage flat base formation. I really like how it outperforms the market and the relative outperformance has a score of 99 (a.k.a better than 99% of the stocks there). The number of funds are increasing for the last quarter and the Sales are really being boosted with +190% Quarter on Quarter and Gross margin has increased to +50.1% (likely because of the higher crude oil prices). In the second picture CODE 33 is lighting green, which is a criteria from Mark Minervini.

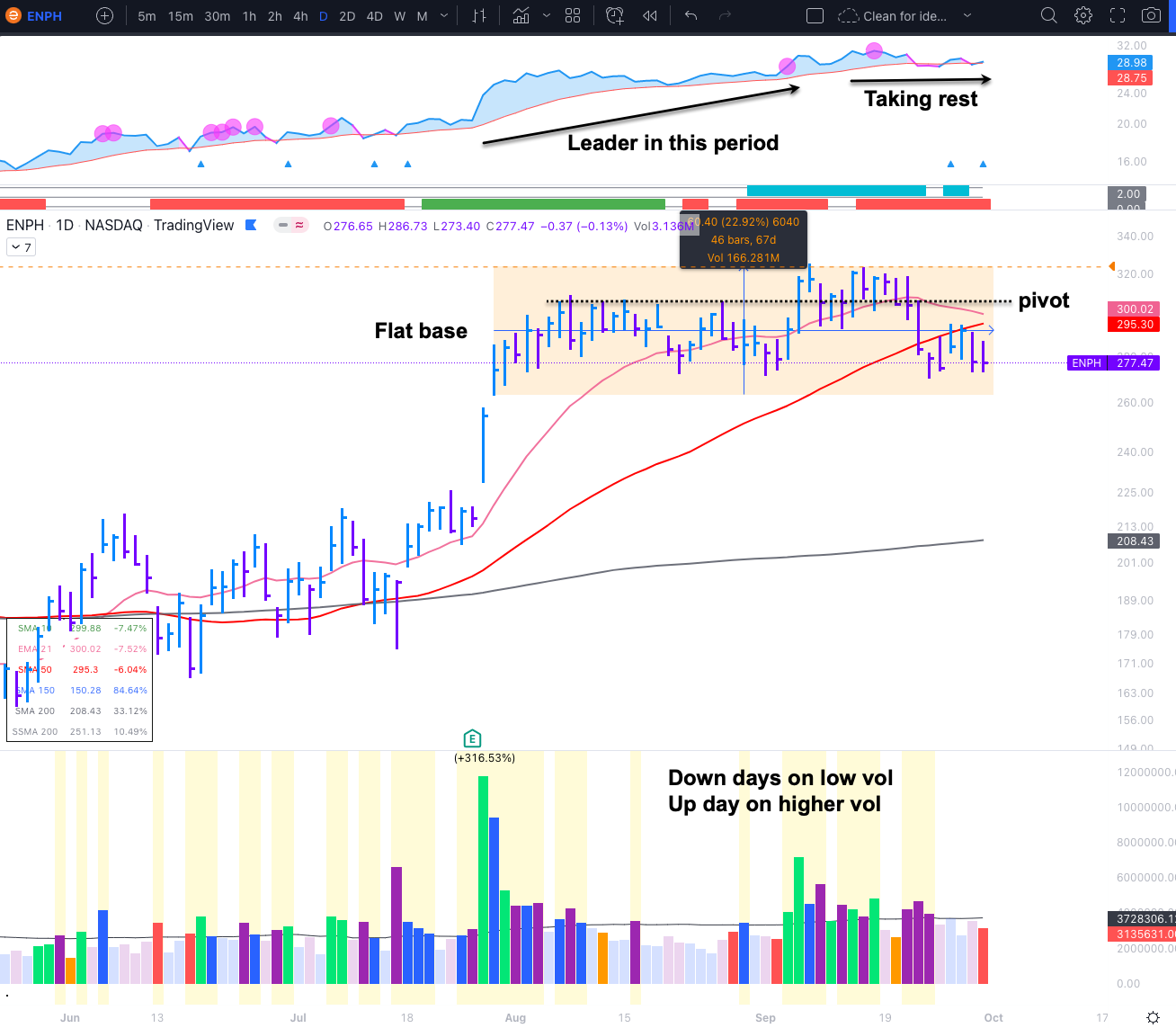

ENPH 0.00%↑

ENPH has been the star on Fintwit for quite some time. It designs, develops and sells home energy solutions. It is from the same industry as FSLR (Energy-Solar). ENPH has been acting like a preceding leader. Fundamentals are also great as Earnings +109%, Sales +68% and Gross Margin increased (again likely because of crude oil prices).

BTU 0.00%↑

BTU is engaged in coal production and sales in US and Australia. Flat base with tight action. It has recently turned up and shows good relative performance.

DINO 0.00%↑

DINO deals with production of high-value petroleum products such as gasoline, diesel and jet fuel. It is part of the Oil and Gas - Refining/Mktg industry. The stock has RS rating of 98 and amazing whooping fundamentals. It is growing at +144% Sales, +543% Earnings and has improving margins of +12.8% (again due to increased oil prices). DINO made a big cup and handle and has formed a mini double bottom in the handle.

BSM 0.00%↑

BSM is in the Oil exploration and Production side of the Oil and Gas Industries. It owns oil and natural gas interests in US. BSM forms Minervini's VCP pattern and ends the formation with a nice shakeout - getting read of the weak hands. What I like after it is the high blue bars afterwards that show great reaction. Stock is in Stage 2 and outperforms the general market. Fundamentals are sound and the 2023 est. EPS is 2.18 +61%, while Sales are growing at whooping +209%. Margins are growing but slower at +61.7% indicating that oil production has costs have also been hit by inflation.

LNG 0.00%↑

LNG is part of the Oil and Gas - Transport industry. It produces and exports liquified natural gas. The stock forms a classic double bottom base after a +30% advancement. The fundamentals are spectacular and the est. 2023 EPS is really at a breakout level of 17.70 +82%, while both Sales have been growing at +165% and Gross Margin has been increasing to +28.2% (crude prices being the reason).

Thank you!

💡These posts consume most of my Sundays! If you have received value:

Share it on Twitter (using the button below)

Subscribe to the newsletter.

This way You will help grow the community together!

Excel tool please

Excel tool please :)