📖 Table of Contents

1.Introduction

2.What is a Double Bottom?

3.Identifying a Double Bottom

4.The Anatomy of a Double Bottom

5.Trading a Double Bottom

6.Example: Double Bottom Chart Pattern

7.Double Bottom Chart Pattern: Trading Tactics

8.Double Bottom Chart Pattern: Practical Take-Aways

9.Double Bottom Chart Pattern: Checklist

10.Conclusion👋 1. Introduction

Welcome to the complete guide on double bottoms! This is Lesson 5 in the series! I have added a section with links to all other articles from the series - make sure you check them out, they have been all updated and expanded as of this weekend.

As a trader, I understand the importance of identifying chart patterns for making profitable trades. Double bottom is one of the most reliable chart patterns used in technical analysis to identify potential trend reversals. In this guide, we will go through the anatomy of a double bottom, how to identify it correctly, and how to trade it.

So, let's dive in!🤿

🤓The Anatomy Series Schedule

Episode 1: Market Cycle

Episode 2: High Tight Flag

Episode 3: Flat base

Episode 4: Cup and Handle

Episode 5: Double Bottom

Episode 6: Saucer Base

Episode 7: 3 Tight Closes

Episode 8: Chart Pattern Cheat Sheet

🤷♂️ 2. What is a Double Bottom?

A double bottom is a bullish reversal pattern that forms after a downward price trend. It signals that the selling pressure is decreasing, and buying pressure is increasing, making it an ideal time to enter a long position. A double bottom chart pattern has two lows that drop below the surrounding price lows yet stop near the same price level. The pattern is complete when price breaks above the highest point in the pattern, known as the confirmation line.

🔍 3. How to Identify a Double Bottom?

Identifying a double bottom is relatively easy, but you must understand what to look for. The pattern consists of two lows that are separated by a peak in price. The two lows should be relatively equal in price and distance apart. The pattern can take various shapes and forms, including the letter "W" or "M." A "W" shaped double bottom is a bullish reversal pattern, while an "M" shaped double top is a bearish reversal pattern.

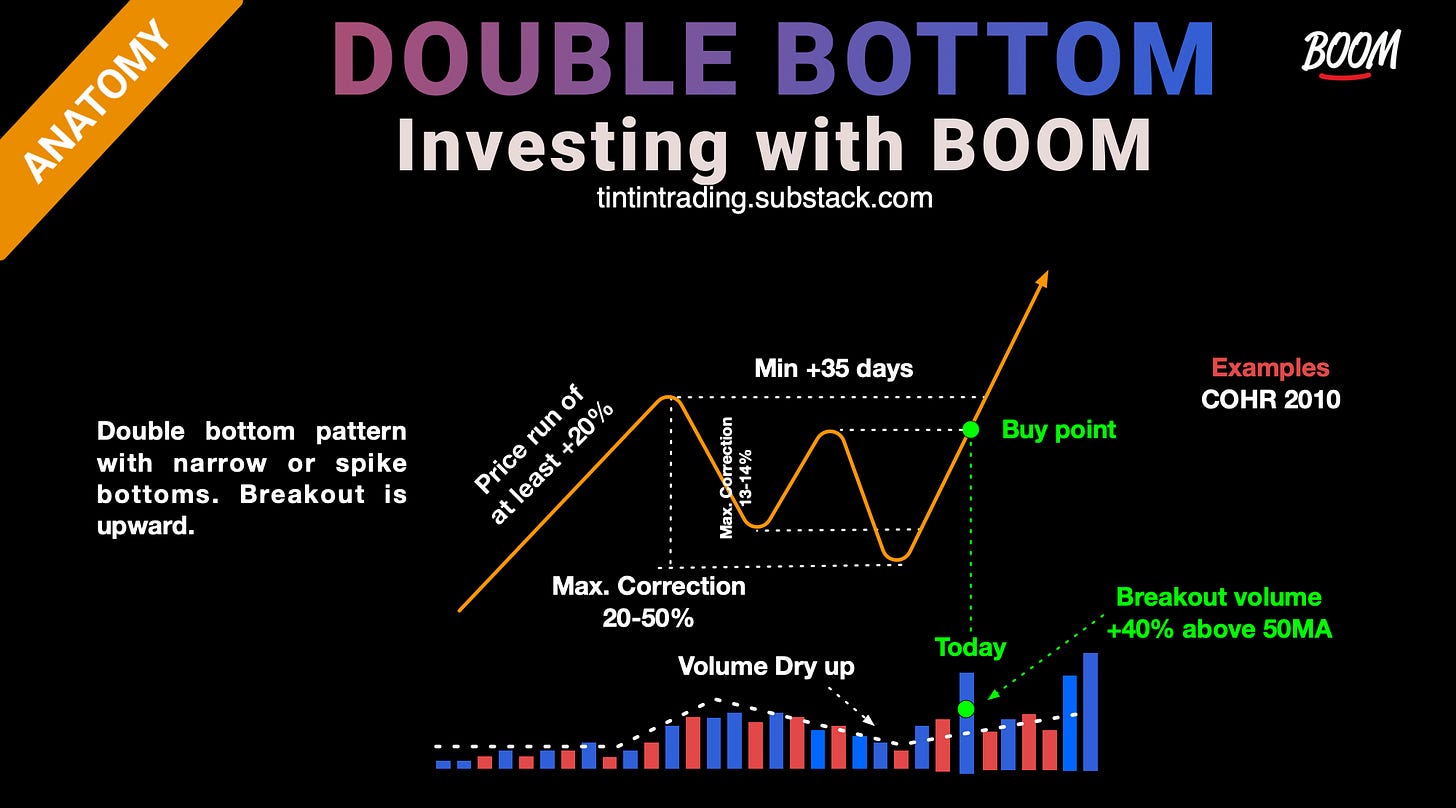

🩻4. The Anatomy of a Double Bottom

The anatomy of a double bottom consists of several key components.

A prior move of the double bottom is a prior advancement above +20%

The first low is the initial point of selling pressure, followed by a rise in price to a peak, and then a drop to the second low.

The second low is the point where buying pressure exceeds selling pressure, and a trend reversal is expected.

Volume is higher on the left bottom than on the right.

The confirmation line is the highest point in the pattern, which signals a breakout and an excellent time to enter a long position.

💸 5. How to Trade Double Bottom

Trading a double bottom involves identifying the pattern correctly, waiting for confirmation, and entering a long position.

Identify the template: Use the Template to identify the base correctly.

Wait for Breakout: A double bottom actsas a reversal of the prevailing price trend. Therefore, it's essential to wait for a breakout (a close above the confirmation line) before entering a long position. Buying before the breakout is an easy way to lose money.

Trade with Market Trend: Double bottoms perform best in a bull market. Therefore, it's advisable to avoid trading them in a bear market. Look at the fundamentals and see if there is a reason for the stock to reverse the downward price trend.

Set a stop loss: The stop loss should be placed below the second bottom, and the target should be based on the measure rule.

Set a target price: The measure rule is the distance between the lowest low and the confirmation line added to the confirmation line. Use the measure rule to compute a target price. Prices hit the target 66% of the time in a bull market and just 48% in a bear market.

It's essential to note that a double bottom is not valid until price closes above the confirmation line. Trading Tactics Here are some trading tactics to keep in mind when trading a double bottom chart pattern.

Additional Ideas:

Check Others in the Industry: Check what other stocks in the same industry are doing. If they are showing signs of bottoming, then the double bottom becomes more important. If the other stocks are continuing down, avoid trading the double bottom. Chances are the stock will fail to perform as expected.

Throwback: A throwback occurs 64% of the time in a bull market and 61% in a bear market. Therefore, you can initiate a position after the throwback completes or add to your position. Wait for prices to begin rebounding and then buy

📊 6. Example: Double Bottom Chart Pattern

Let's take a look at an example of a double bottom chart pattern.

COHR 0.00%↑ Example

In this example, we are looking at the bottom formed at the end of a downward price plunge. The twin spikes (bottoms) drop well below the surrounding price lows yet stop near the same price level. Volume is higher on the left bottom than on the right, and the confirmation line marks the highest high in the pattern.

🧮Double Bottom Statistics

The Double Bottom base is a more frequent occurrence than any of the other bases discussed in the series. Here are the key findings for these bases.

Summary of Statistics

Success rate: 66% meeting the price target (price target explained above)

Average rise: 35% in a bull market and 24% in a bear market

Throwback rate: 64%

Break-even failure rate: 5%

Throwbacks hurt performance. Tall patterns perform better than short ones. Performance improves for those patterns with a lower right bottom, a declining volume trend, dome- shaped volume, heavy breakout volume, and volume heavier on the left bottoms.

📝 Practical Takeaways

Practical Take-Aways Here are some practical take-aways to keep in mind when trading a double bottom chart pattern.

Look for a downward price trend leading to the pattern.

The shape of each bottom should appear similar.

Look for a rise between the twin bottoms of at least 10%.

The price variation should be small from the lowest low on the left bottom to the low on the right.

The distance between the bottoms should be 3 to 6 weeks apart.

The left bottom usually shows higher volume.

🎉 10. Conclusion

Double bottom chart pattern is a reliable chart pattern used in technical analysis to identify potential trend reversals. Identifying the pattern correctly, waiting for confirmation, and entering a long position can lead to profitable trades. It's important to follow the trading tactics, practical take-aways, and checklist to ensure a good double bottom chart pattern. With practice and patience, you can become proficient in identifying and trading chart patterns like a pro.

🤓The Anatomy Series Schedule

Episode 1: Market Cycle

Episode 2: High Tight Flag

Episode 3: Flat base

Episode 4: Cup and Handle

Episode 5: Double Bottom

Episode 6: Saucer Base

Episode 7: 3 Tight Closes

Episode 8: Chart Pattern Cheat Sheet