🫓Flat Base Setup - Anatomy

Anatomy of charts. Episode 3

Success has many friends - Greek Proverb

This post introduces you to another long time friend of mine and hopefully a friend of yours too. It is the Flat Base. Unlike our first friend the Power Play, who is a bit of an adrenaline junkie, the Flat Base is very chilled. And like many good friends it is easy to recognise and it is reliable. The only drawback is that they are rare among very popular stocks, since the flat base is the pure illustration of the battle between buyers and sellers.

📖Table of contents

1. Introduction

2. What are flat bases?

3. How to identify a Flat Base?

4. Stages of a Flat Base Formation

5. How to Trade Flat Bases?

6. Ideal Buy Point

7. Examples

8. Insights from the Analysis of Rectangle Bottoms

9. Practical Takeaways

10. Conclusion👋Introduction

If you're a stock trader, you've likely heard of flat bases. In this article, we'll go over everything you need to know about flat bases and how they can be used to make informed investment decisions.

🤷♂️What are Flat Bases?

Flat bases, also known as Rectangle Bottoms, are a common chart pattern in stock trading. They are called "flat" bases because they are characterized by a period of price consolidation, where the stock's price moves sideways. The base is usually longer and flatter than other types of bases, and it indicates that buyers and sellers are in equilibrium. When the stock breaks out of the base, it signals a potential buying opportunity for traders.

🔍 How to Identify a Flat Base?

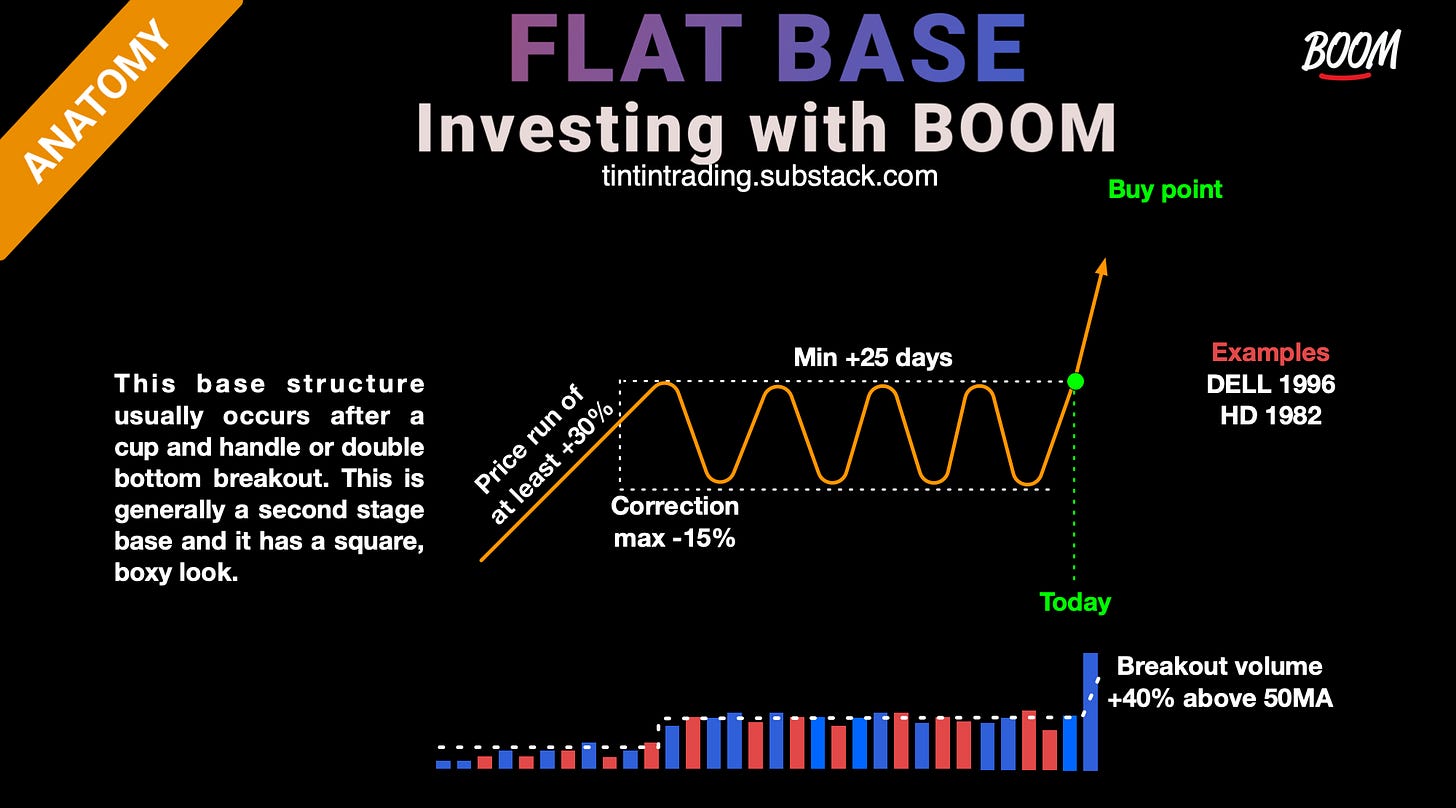

Flat bases are typically the second stage in a stock's chart pattern. They form after the stock has successfully broken out of another base. To identify a flat base, look for the following characteristics:

The stock has advanced by at least 30% in the prior price run.

The base formation lasts at least 25 days and is no more than 15% from high to low.

The breakout occurs on at least 40% volume compared to the 50-day moving average.

To qualify as a flat base it is good that the price touches the support and resistance (trend lines) at least twice.

The volume during the base formation is exceptionally low and flat, with no big up or down days.

📊 Stages of Flat Base Formation

Flat bases form in three stages:

Stage 1: The stock price moves up, preferably out of a previous base.

Stage 2: Base formation - the period where trading is range-bound.

Stage 3: Breakout - the point where buyers finally take control of price action, gather additional interest, and force shorts out.

💰 How to Trade Flat Bases

Trading flat bases can be a profitable strategy if done correctly. Here are some tips for trading flat bases:

Identify potential flat bases: Use the template provided in this article as criteria provided in section How to identify a Flat Base?

Watch for the breakout: Once a potential flat base is identified, keep an eye on the stock's price action. The breakout should occur on high volume, indicating that there is strong interest in the stock. This is your ideal buy point.

Set a target price: While I do not advise to have a target where you take all your profits, I usually have a point where I adjust the risk profile of the trade. This means that I will not let it become a loser. For Flat Bases the target price is the price resulting from adding the height of the base (resistance price - support price) to the resistance price.

Set stop-loss orders: To limit potential losses, set stop-loss orders to automatically sell the stock if it drops below a certain price. For the Flat Base this is the bottom of the base.

Throwbacks and gaps tend to hurt performance. Also wider patterns perform better than shorter patterns. If volume is falling within the pattern formation, the base has increased probabilities. Finally, if the breakout happens on strong volume price moves further higher.

🔎 Ideal Buy Point

The ideal buy point for a stock in a flat base is when it breaks out of the base with a high trading volume, confirming the trend. The buy point is usually 10 cents above the highest point of the base. A volume backed breakout from this level suggest that something is brewing 🍻.

📚Example

Dell in April 2021 provides an excellent example of a flat base before continuing its journey upward. Another example is Alphabet Inc., which formed a double flat base in 2015, followed by a successful breakout.

DELL 0.00%↑ Example

DELL April 2021 makes a flat base before continuing its journey up.

AMZN 0.00%↑ Exmaple

Another example of a successful flat base breakout is Amazon's breakout in late 2019. The stock formed a flat base with a buy point of $1,823.50. The breakout occurred on high volume, and the stock continued to rise at +20% straight up.

ZM 0.00%↑ Example

Another example is Zoom Video Communications, which formed a flat base in 2020. The stock broke out on high volume in June 2020, and the price continued to rise, reaching a high of $588.84 in October 2020.

As you see Flat Bases (also called Line Formation Bottoms or Rectangles) are as old as the sun.

💡 Statistical Insights from the Analysis of Rectangle Bottoms

The Flat base is a more frequent occurrence than the Power Play (High Tight Flag). Here are the key findings for these bases.

Summary of Statistics

Success rate: 80% meeting the price target (price target explained above)

Average rise: 39% in a bull market and 20% in a bear market

Throwback rate: 64%

Break-even failure rate: 9%

Since you cannot predict the breakout direction with complete accuracy, wait for the breakout before investing. Place the trade after price closes outside the rectangle trendline, and then trade with the trend.

📝 Practical Takeaways

Here are some practical takeaways when it comes to flat bases:

Keep an eye out for flat bases when searching for stocks to invest in.

Look for a stock's ideal buy point by identifying when it breaks out of the base with high trading volume using the template criteria in this post.

Always do your own research and analysis before investing in any stock.

📈 Conclusion

Flat bases are an important chart pattern in stock trading. They can indicate potential buying opportunities for traders and can be used as a profitable trading strategy if done correctly. By understanding the characteristics of flat bases, identifying potential flat bases, and waiting for the breakout and confirmation, traders can make informed investment decisions. Remember to always do your own research and analysis before making any trades.

The Anatomy Series Schedule

Episode 1: Market Cycle

Episode 2: High Tight Flag

Episode 3: Flat base

Episode 4: Cup and Handle

Episode 5: Double Bottom

Episode 6: Saucer Base

Episode 7: 3 Tight Closes

Episode 8: Chart Pattern Cheat Sheet